People are spending more money online than ever before. In 2015 alone, some 1.011 billion online orders were placed in the UK[1], a figure which is only set to grow further as consumer spending continues to migrate from the high street to the internet.

For ecommerce retailers, this growth is especially pronounced during the holiday season, which constitutes the busiest and more profitable time of the year. In fact, nearly one in four of the year’s total online purchases are made throughout the festive months of November and December.[2]

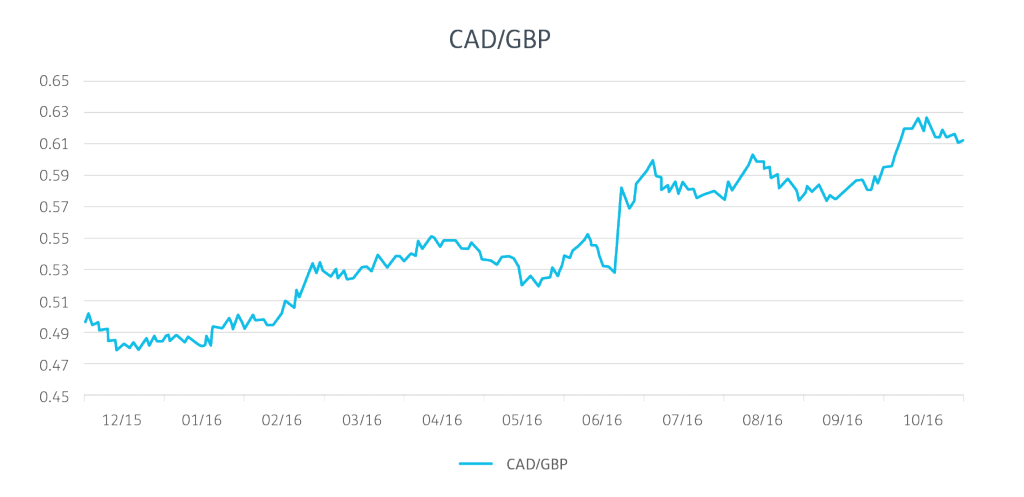

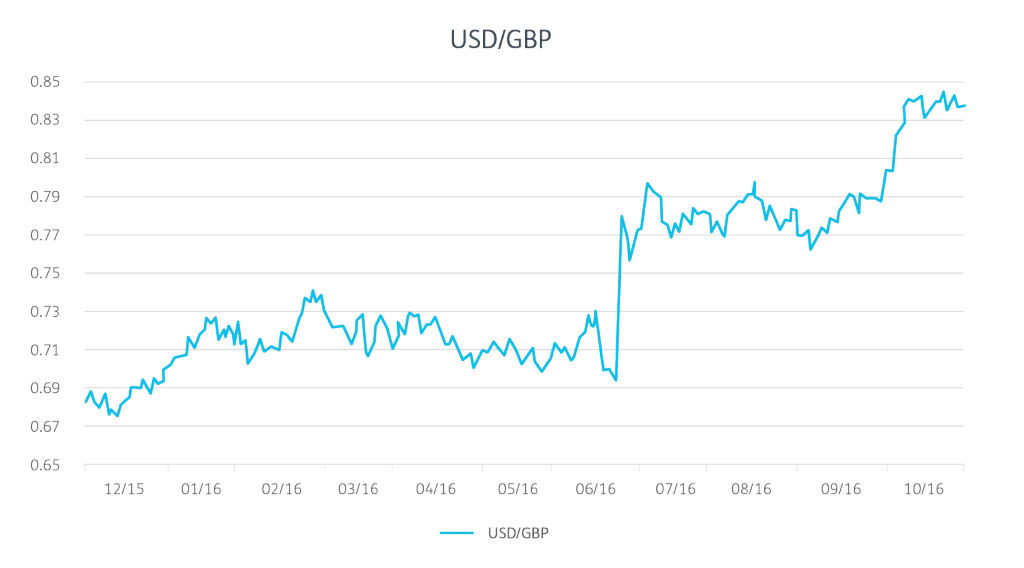

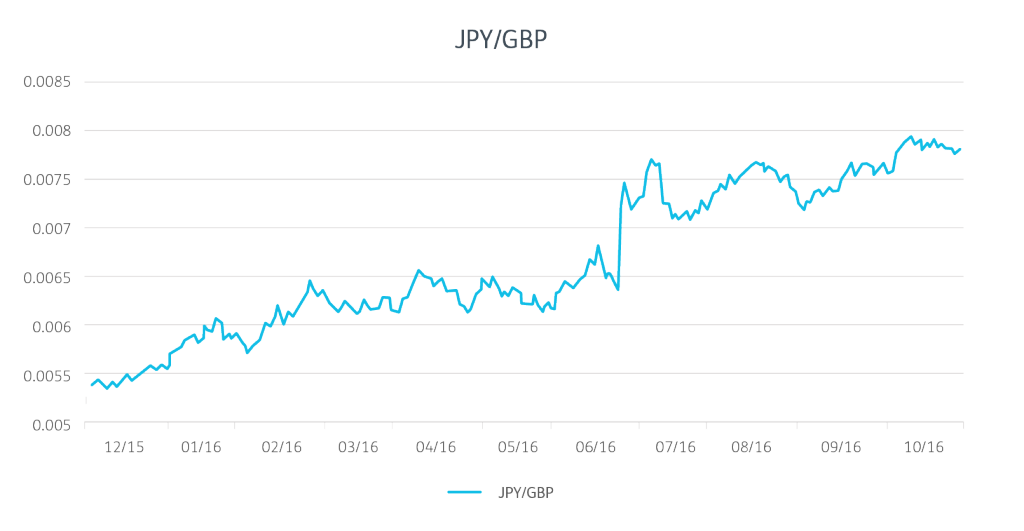

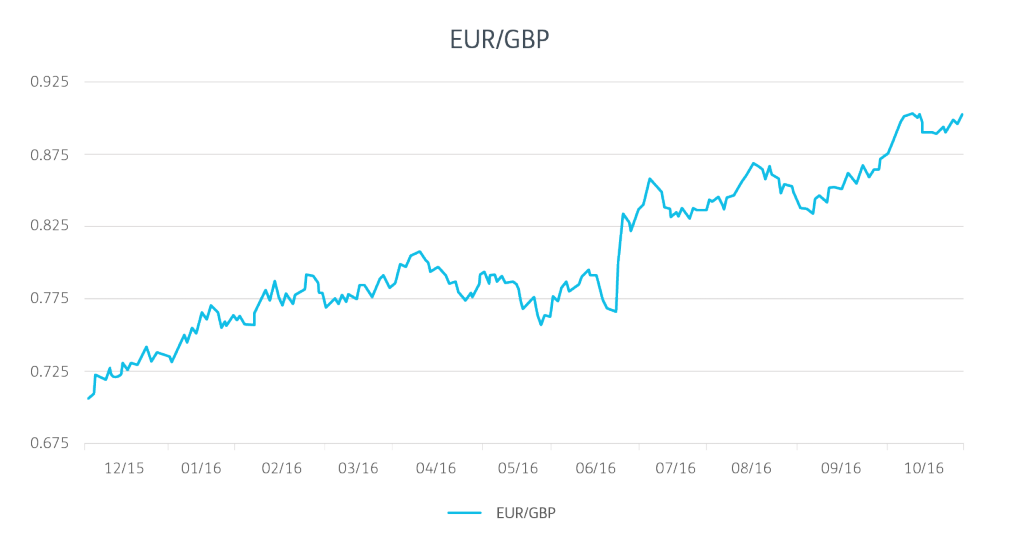

As illustrated in the charts below, following precipitous falls in sterling to multi-year lows, the majority of key global currencies are now up significantly against the pound. Since this time last year when compared against GBP, the US dollar is up 20.7%, the Canadian dollar is up 19.7%, the euro is up 25.1% and the yen is up a staggering 44.2%.[3]

While a weak GBP may bring real headaches for domestic businesses this Christmas, for UK-based e-tailers with exposure to international markets, if approached strategically, it could bring the opportunity to boost profits.

So, how can you make the most of the markets this Christmas? Here are three handy tips:

So, how can you make the most of the markets this Christmas? Here are three handy tips:

1. For UK ecommerce retailers marketing products abroad, the exchange rate for selling into many markets is better now than it has been in years. This means you can target an even wider international customer base simply by pricing your goods competitively in foreign currencies. And now, you can do this while still maintaining (or possibly even improving) profit margins at home. Of course, for those with international exposures, keeping an eye on market movements is critical; you can set-up a free rate alert here.

2. Another way to make the most of the exchange rates this holiday season is to set up local receiving accounts in the markets where you sell. This way, you can collect payments from overseas marketplaces in the local currency and repatriate earnings when the timing is right for you.

3. And finally, to help take the hassle out of high trade volumes this holiday season, you can work with a dedicated FX specialist. Using a specialist, like World First, can help to keep costs down by avoiding the high payment fees and poor exchange rates typically provided by online marketplaces and banks, while ensuring your payments are made quickly and transparently.

Exclusive offer for new World First customers: receive £30 credit towards your first currency transfer over £1000 before 31/01/2017. Quote: XMAS30.*

*Read the full terms and conditions here.

[1] Experian IMRG

[2] BBC

[3] Comparing 4th Nov 2016 with 9th Nov 2015, Bloomberg