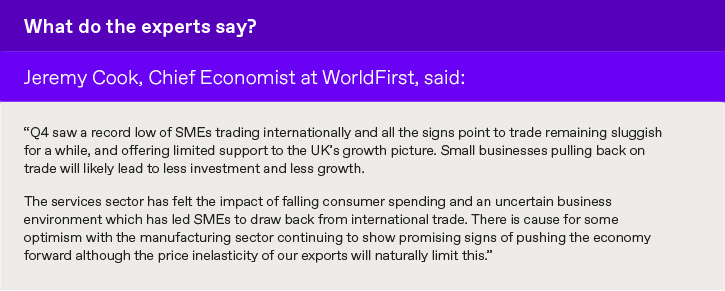

After a stagnant year of growth and global trade for UK SMEs, the last quarter of 2017 saw the tide shift with more small businesses optimistic about growth prospects and international trade coming back into focus. Whilst the amount of SMEs trading internationally continued to decline and average transfer values remained stagnant, there were signs of pickup in exports and certain sectors such as manufacturing thrived.

Executive Summary – Q4 2017

- Fall in SMEs trading, but values remain the same

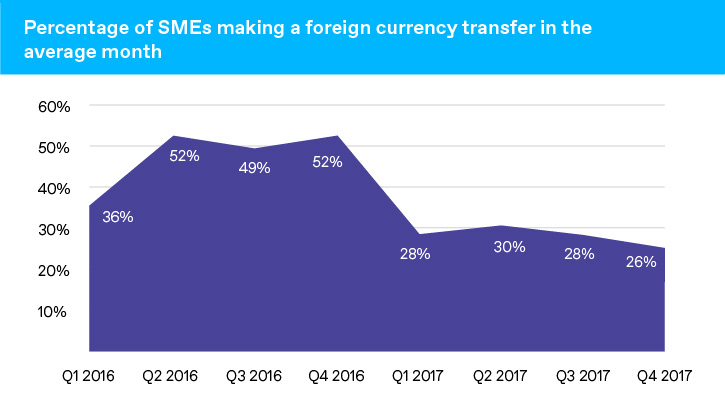

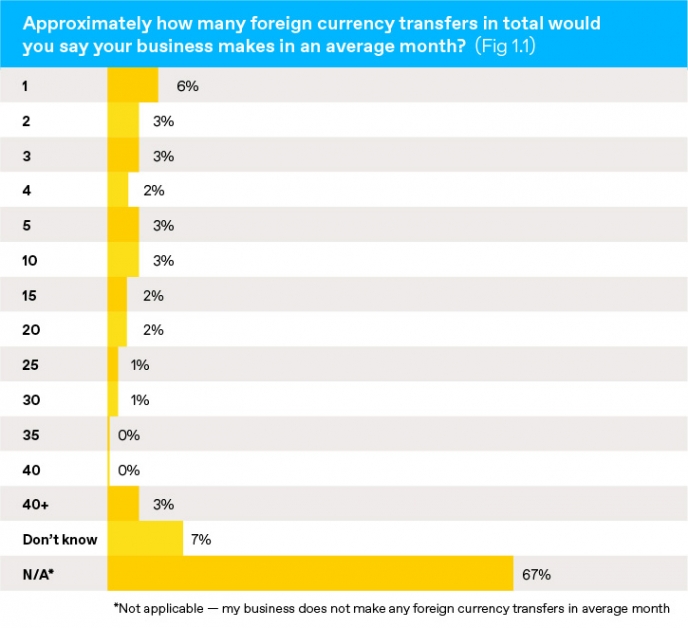

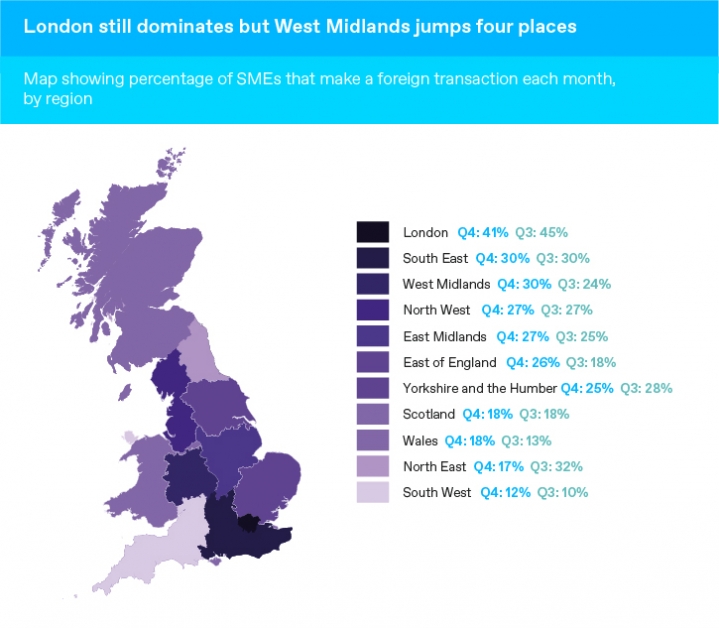

Q4 saw a slight decline of SMEs trading for the fourth consecutive period with only 26% of businesses making a foreign currency transaction in the average month. This is 50% less than the amount trading during the same period in 2016. In real terms, that means 800,000 fewer SMEs are trading internationally than they did last year.

- SMEs give up on growth

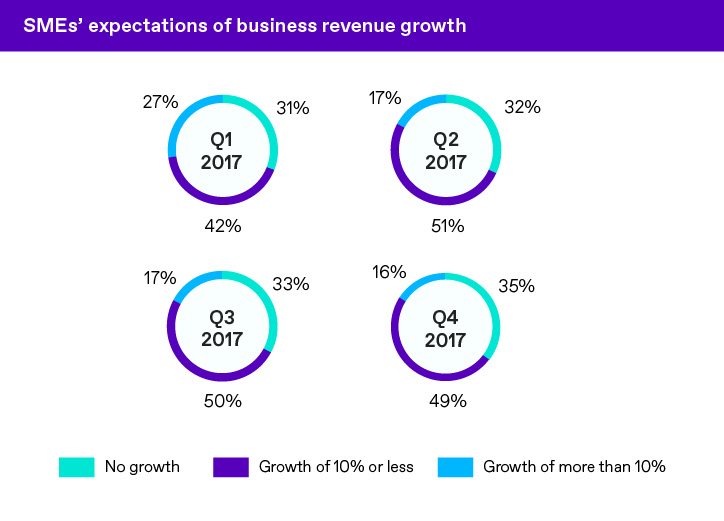

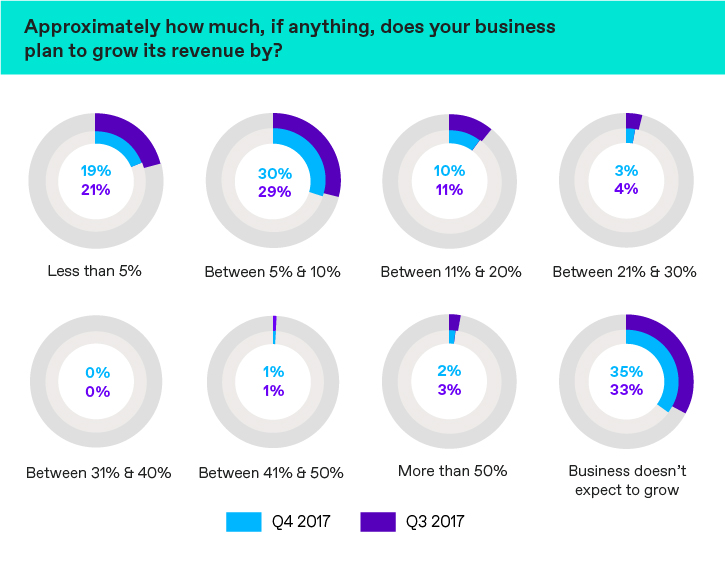

Growth expectations are at an all-time low with 35% of SMEs not expecting to grow in the next year. Whilst only a small increase of 2% over the quarter, the continuous decline in SMEs expecting to grow is cause for worry for the UK economy.

- Cost pressures affect SME hedging behaviour

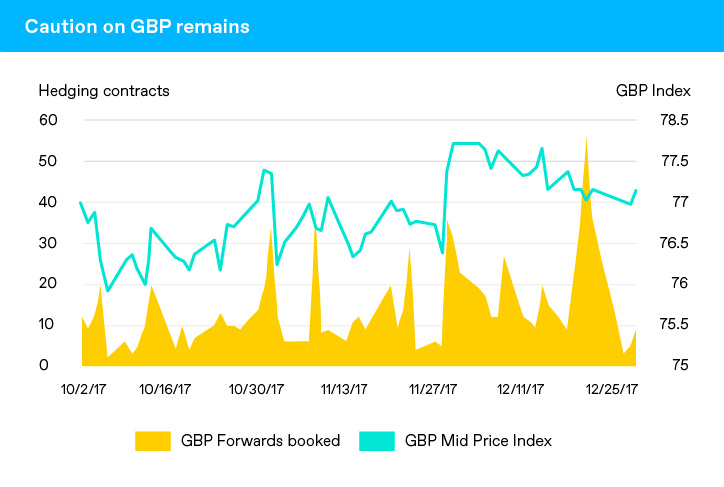

British SMEs remained keen to take advantage of short term spikes in the value of sterling when buying forward contracts in Q4. While this may seem obvious, it further suggests that importers are looking for any relative pricing advantage they can benefit from given high levels of factory gate inflation and the relative pressure it has put on margins.

SMEs and global trade: Where are we now?

Number of SMEs trading internationally halves in a year

The decline in SMEs trading internationally continued into Q4 2017 with only 26% of businesses making a trade in the average month, demonstrating a fall of 2% from the previous quarter and a continuing decline for SMEs trading internationally. The results show that the number of small businesses trading internationally halved over the course of the year, falling from a peak of 52% in Q4 2016

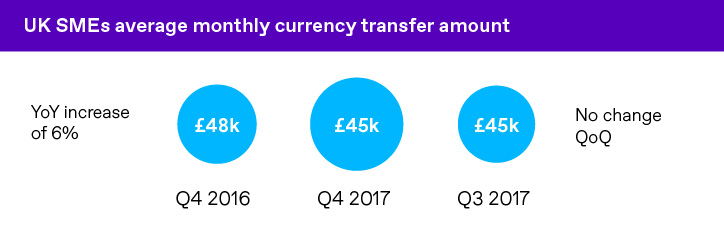

Whilst fewer SMEs are trading, average trading amounts have remained fairly consistent at £45,000 in Q4 and Q3. However, this does represent a slight decline from the same period in 2016 which saw an average trade value of £48,000.

UK SME trading partners: Exports pick up

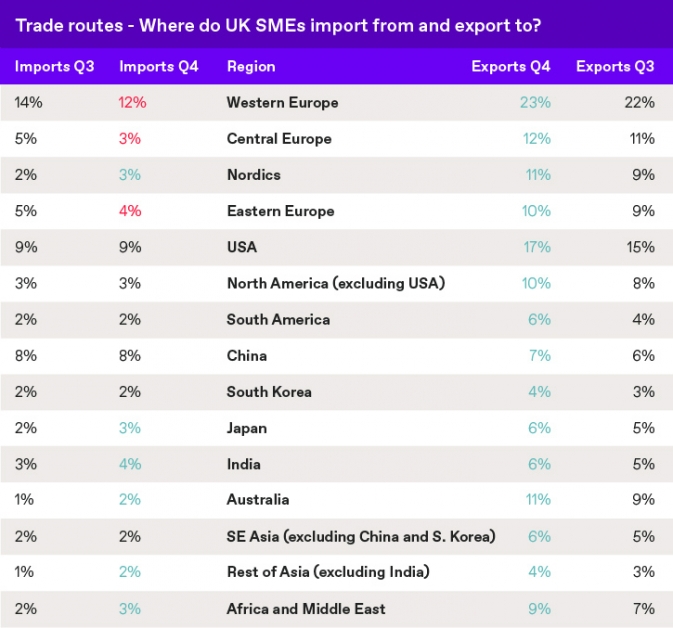

The number of SMEs exporting is declining. However, those who do take the plunge are trading with more markets than ever. All trade routes saw a slight increase in exports from UK businesses with the biggest increase to the Americas (USA, North America and South America).

Whilst most import and export figures stayed similar, SMEs are beginning to turn away from Europe with decline in imports from Western, Central and Eastern Europe. Instead, SMEs picked up imports from emerging economies including Asia, Africa and the Middle East.

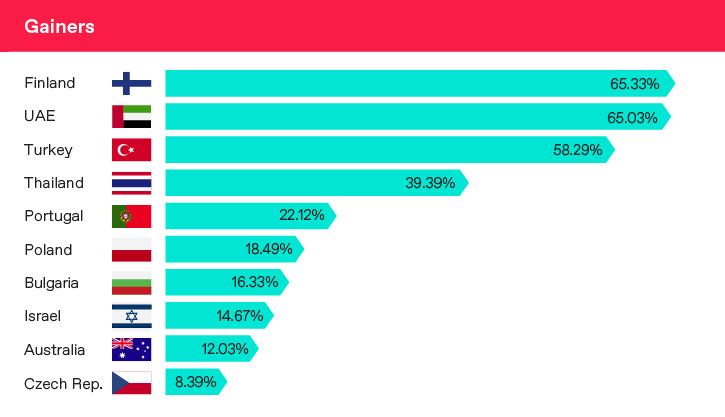

Payment flows: UK SMEs increase trading with East Europe

Like the past two quarters, there has been an increase in payment flows to Eastern Europe including Turkey, Poland, Bulgaria and the Czech Republic reflecting the changing makeup of small businesses in the UK

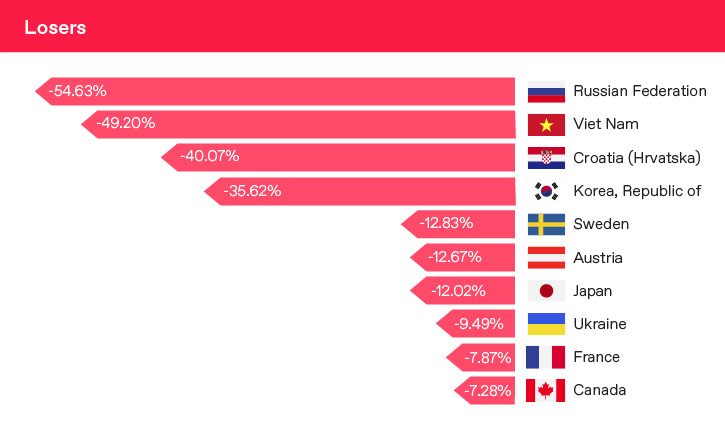

The biggest fall in payments were seen in Russia, Vietnam and Croatia respectively with all countries experiencing a decline of over 40%.

*Only includes destinations where over 100 payments were made

Future of global trade: What’s next for UK SMEs?

SMEs increasingly downbeat on growth prospects

SMEs expecting to grow fell to a record low in Q4 with 35% not expecting any growth even during the busy festive period. This is 2% lower than in Q3 and 4% less than at the beginning of 2017 highlighting the increasing pessimism amongst UK SMES.

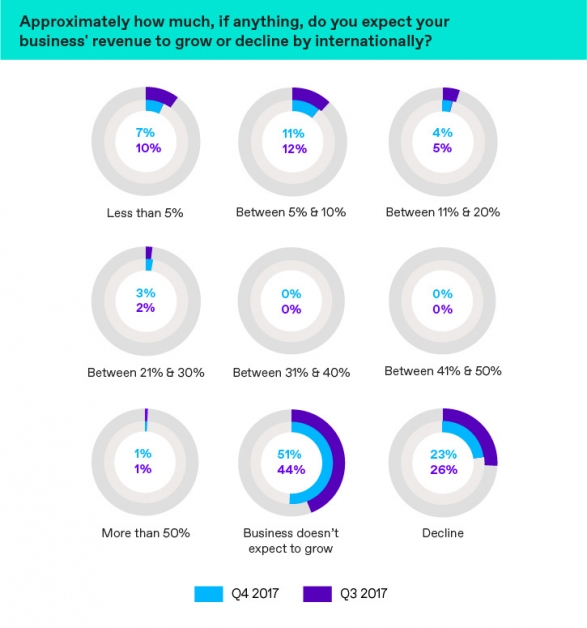

International growth was the biggest driver of this pessimism with 74% of SMEs expecting revenue to stay stagnant or decline in the next quarter. As in Q3, only 8% of SMEs expect to grow internationally by more than 10%.

UK SMEs retreat from global trade

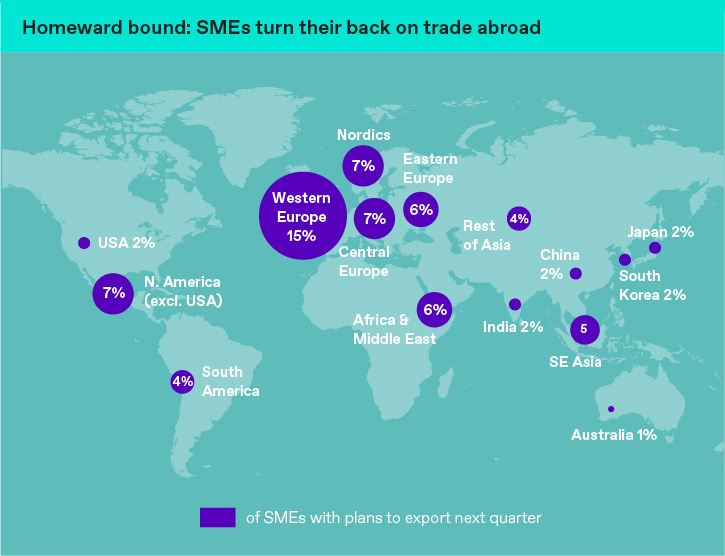

With many SMEs expecting international growth to remain stagnant or decline, it is no surprise that fewer are planning to increase exports to more regions.

- Only 29% of SMEs plan to export in the near future compared to 31% in Q3

- As in Q3, fewer SMEs are planning to export to more regions

- The most popular region to expand into remains Western Europe with 15% of SMEs looking to export there in the next quarter

Currency and protection What’s shaping SME behaviour?

British SMEs remained keen in Q4 to take advantage of short term spikes in the value of sterling when buying forward contracts. While this may seem obvious, it further suggests that importers are looking for any relative pricing advantage they can benefit from given high levels of factory gate inflation and the relative pressure that has put on margins.

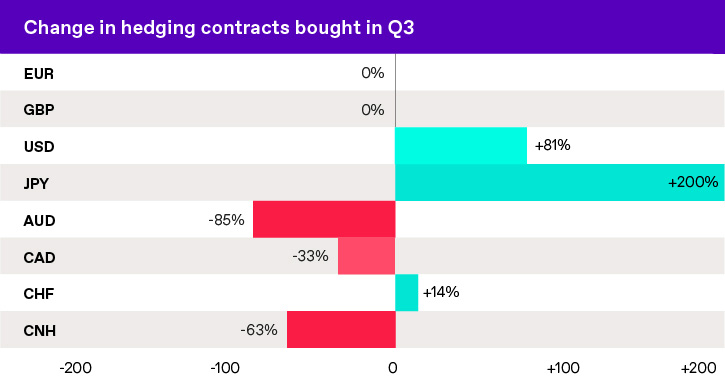

Dollar and Yen most in demand for hedgers

Post-referendum highs in GBPUSD and GBPJPY were gobbled up by SMEs looking to protect themselves against currency volatility.

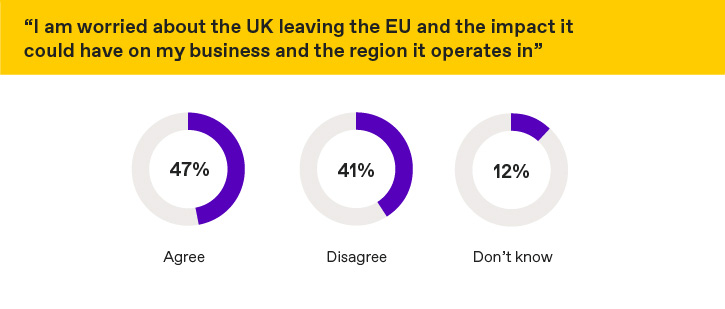

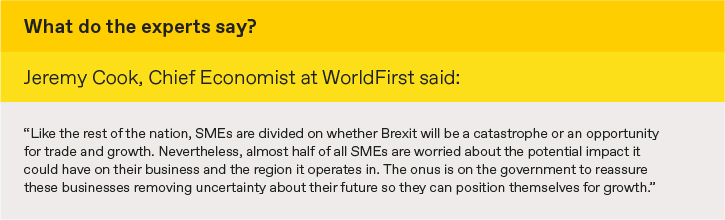

SMEs divided on Brexit impact

Sentiment towards Brexit is split down the middle with SMEs divided on the impact it will have on business and the regions they operate in. 47% are worried about the potential impact compared to 41% who are not concerned.

There were significant variances across sectors with 64% of those in the transportation and distribution sector worried about the obvious impact on their ability to move people and goods across borders. The construction sector was the most confident about prospects post-Brexit with only 36% worried about the impact.

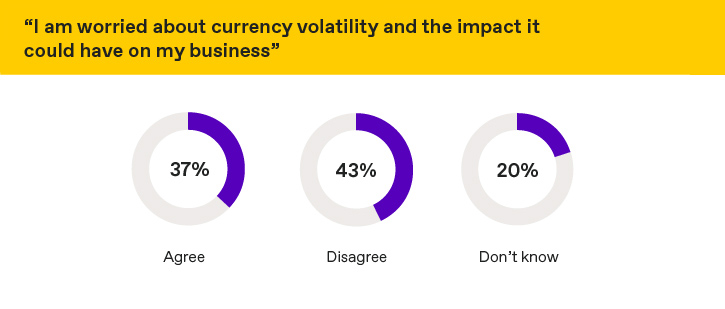

Currency volatility has been the most notable impact of the UK’s decision to leave the EU in 2016 with the pound plummeting in the months after. However, after a year of negotiations, SMEs are feeling more positive about the impact currency volatility could have on their business.

Only 37% were worried about currency volatility compared to 45% of SMEs in the same period in 2016. Sterling has steadied over the last year and the large scale movements seen in 2016 have been few and far between, increasing SME confidence in their ability to manage currency risk.

The SME sentiment tracker: What’s affecting global trade?

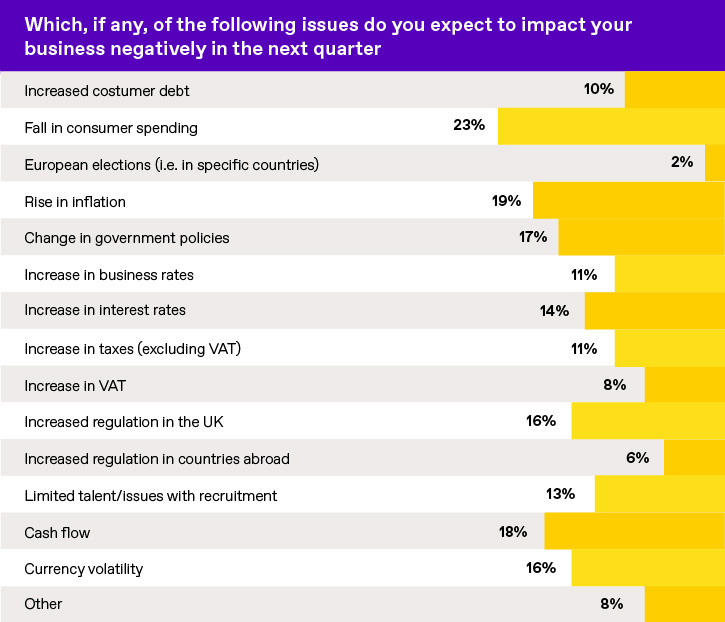

The decrease in consumer spending has resumed its spot as the biggest worry for UK SMEs in Q4 after concerns about rising inflation dropped from 25% to 19%.

As before, fewer SMEs are worried about the impact currency volatility will have with only 16% expecting it to negatively impact their business.

Cash flow is an increasing worry for small businesses with 18% expecting it to negatively impact them, up from 15% in Q1.

World First SME Global Trade Barometer

Research Methodology

All figures, unless otherwise stated, are from YouGov Plc. Total sample size was 1020 senior decision makers in small/ medium British businesses. Fieldwork was undertaken between the 5th-13th of February 2018. The survey was carried out online. The figures have been weighted and are representative of all British business sizes.

World First data on client contracts was collated between 1st October 2017 and 30th December 2017 and refers to UK corporate desk clients only.

Notes

- A forward contract is a contract to exchange a specific amount of one currency for another on a future date, at a predetermined rate. A deposit is normally required for forward contracts.

- To hedge or hedging is to protect against future currency movements

- In this report, ‘FX’, ‘foreign exchange’ and ‘foreign currency transfers’ refer to the buying/ selling of international money (including the payment of international money).