How do Exchange Rates Affect a Business?

The ways in which businesses are effected by currencies can be roughly divided into transactional, translational, credit and liquidity risks. All four of these categories can then be subdivided a number of times to fit any and all kinds of businesses. But we’ll be focusing mainly on the transaction side – where the majority of foreign exchange impacts can be seen. Here, we outline a few examples of how foreign exchange markets can be a headwind or a tailwind to UK businesses.

Supplier payments

When paying a supplier, it’s this exchange rate exposure that can make a difference to your business. If, for example, you’re contracted to pay a French supplier for a shipment of goods in six months’ time at a cost of €50,000, every percent of change in the EUR/GBP rate will have a direct impact on your bottom line. At the time of writing, the EUR/GBP exchange rate sits at 0.91, making your final bill £45,500 if paid today. However, should the value of the pound fall by 2.5%, EUR/GBP would rise to over 0.93, lifting your supplier payment to over £46,500 – meaning you’re paying an additional £1,000 for the same shipment of goods. Nonetheless, should exchange rates move in your favour (the pound strengthening in this example) then you’d end up forking out less for your euro payment.

While supplier payments and exporting are some of the more upfront ways in which exchange rates can affect you and your business, there are a plethora of ways currency volatility can trickle into your business. These are namely transactional, translational, credit and liquidity exposures:

Sales forecasts

For multinational companies, sales forecasts can be any of the following: headache, hindrance, tailwind or motivator. Where they become more complicated is when sales are listed in another currency and what looks like a firm beat on your well thought-out sales forecast turns to pennies when the exchange rate moves against you.

Balance sheet hedging

Any finance director or CFO who’s got experience dealing with multinational companies will know that holding assets and liabilities in a variety of currencies can be a burden. When you’re creating or submitting financial documents, balance sheets can be subject to sharp revisions or remeasurements if the value of an asset or liability has changed due to foreign exchange fluctuations. A loan taken out in Japanese yen will look very different on your sterling-denominated balance sheet from one quarter to another if currency markets are volatile, unpredictable and changing.

These are just a few examples of ways in which currency markets can impact individual businesses. For the broader economy, the implications of a volatile currency can be more nuanced.

The broader economy

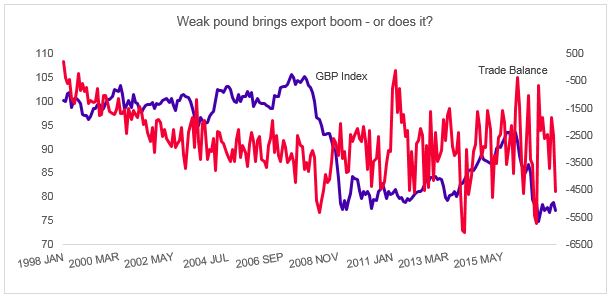

While the effects of fluctuating exchange rates aren’t immediately obvious for those buying goods on the high street, paying your gas bill or procuring machinery for your new venture, the nature of the UK economy leaves businesses and the wider economy highly sensitive (for better or worse) to movements in the price of the pound. The same might not be said for importers and exporters – who’ll feel the gains/losses of foreign exchange fluctuations almost immediately – and that’s clear in the monthly trade statistics for the UK:

Source: ONS, Bank of England

During periods where the pound’s weakened, for example from 2008-2012 in the graph above, the volume of goods and services exported from the UK has grown. The trouble is, it hasn’t grown sufficiently to outweigh the costs that are incurred through higher import costs – thereby depressing our trade balance figures and preventing a weaker pound from driving economic growth.

How can small businesses/SMEs combat, control and manage the affect of exchange rates?

It’s not the nature of these risks themselves, but how you deal with them that will make a difference to your business. There are a number of different methods and techniques with which to approach currency markets.

Transferring money can be simple – spot contracts and short-term forwards can be a quick, easy and efficient way of moving your funds from one currency to another. But, this may introduce an element of risk to your business as there’s effectively no way of predicting what the exchange rate will be on your future transfers. So how can you know what your profit margins will be in one week, month or even years’ time? For some businesses, using hedging strategies or longer-term forwards can trim some of this risk and more complex payment solutions can be more suited. At the end of the day, it all comes down to you, your business and the way you approach foreign exchange.

- Spot transfer

A spot transaction is arguably the simplest way to transfer money across borders. Enquire at any currency specialist to receive a rate quote (this will usually be the interbank rate with a spread applied), once this is booked you send the broker the funds for the trade, which are then sent on in your chosen currency.

- Forward contracts

If you want to secure a rate but aren’t yet ready to make a transfer, you can choose a forward contract to fix a rate today for a specified date in the future. The great thing about a forward contract is that you know now exactly how much you’ll get when you’re ready to transfer. It helps you plan and protects you should rates move against you later. However, a forward contract could work against you if rates move in your favour after you have secured a rate. We strongly recommend that you chat through your options with one of our dealers before choosing what’s best for you.

Conclusion

According to our Think Global research conducted last year, just 5% of SMEs currently intend to begin exporting at some point over the next half-decade, which leaves the UK in the bottom five European nations sorted by percent of SMEs exporting. Much of this hesitance to exporting is a direct result of uncertainty that stems from the impact and complications that FX can bring to businesses. It’s overcoming this uncertainty with confidence that’s key to success.

If the UK is to retain its status as an open, global and forward-looking nation, SMEs should approach international trade and foreign exchange markets with greater confidence. Furthermore, over half of all SMEs have experienced a rise in profits as a direct result of exporting, amounting to an average of £287,000 of additional revenue received per year.

The rewards are demonstrably out there, and with an informed, up-to-date and reactive strategy, tackling foreign exchange markets is within reach of every company in the UK, regardless of size, headcount or previous experience.

| Make international payments faster and cheaper with WorldFirst. | |

|---|---|

| Sign up today – and start saving! |