SMEs pessimism towards international trade reached new lows at the end of 2017, according to the latest Global Trade Barometer from WorldFirst, the international payments expert.

The number of UK SMEs trading internationally dropped to just 26% in Q4 2017, meaning figures were down by half compared to the end of 2016 (52%). This decline translates to 1.5 million fewer SMEs trading internationally last year.

Rock-bottom confidence

The future outlook for international trade also looks gloomy going into 2018 with 75% of UK SMEs expecting trade to decline or remain stagnant over the next twelve months.

Despite expectations that a weaker sterling would boost international exports, hopes were dashed as SMEs remained reluctant to pursue overseas opportunities due to market uncertainties. In Q1 2017, only 31% of SMEs planned to export over the coming quarter. That number dropped to 29% by Q4, the lowest figure for a year.

This lack of fortitude will be a particular worry after the UK government spent 2017 promoting the benefits of international trade as it prepares to leave the European Union in 2019.

Domestic concerns for SMEs

On top of reservations around international trade, possibly even more worrying was UK SMEs’ outlook for domestic opportunities.

In Q1 2017, 43% of SMEs thought they would grow by 5% or more over the next quarter, but by the end of the year only 38% predicted the same growth prospects into Q1 2018.

Glimmer of hope

While negative sentiment towards international trading peaked, general Brexit worries have significantly diminished amongst UK SMEs.

In Q4 2016, only a third (33%) of small businesses were broadly positive about leaving the Union, but by Q4 2017 41% admitted to being positive about our exit.

Despite largely negative sounds from UK SMEs over the last quarter, there were some signs that small businesses may look to return to international trading in the longer term.

Although the number of SMEs trading internationally has fallen, the reach of those still braving trading headwinds has expanded.

The Global Trade Barometer recorded increases in the number of UK traders exporting across all regions including Western Europe, North America and Asia, proving there are growth opportunities for those who are confident enough to trade beyond our shores.

This was reflected in average trading amounts, which rose consistently in 2017. In Q4 2017, average monthly trading amounts rose to £45,536, increasing from £45,000 in Q3.

Jeremy Cook, Chief Economist at WorldFirst, said: “After a year of Sterling fluctuation, inflation fears and obfuscation around the government’s Brexit negotiations, it’s little surprise that our SMEs’ appetite to trade internationally is at rock bottom. There were too many unknowns in 2017 and international trade suffered as a result.

“The only positive to come from such a negative year may be that UK SMEs are seemingly drowning out the Brexit noise. Since the end of 2016, a significantly larger contingent of small businesses feel positive about leaving the EU. The pound is stronger than it’s been since the referendum and many SMEs may finally have plans in place for a post-Brexit world. We can only hope this translates into businesses dusting themselves off and getting back to international trading in 2018.”

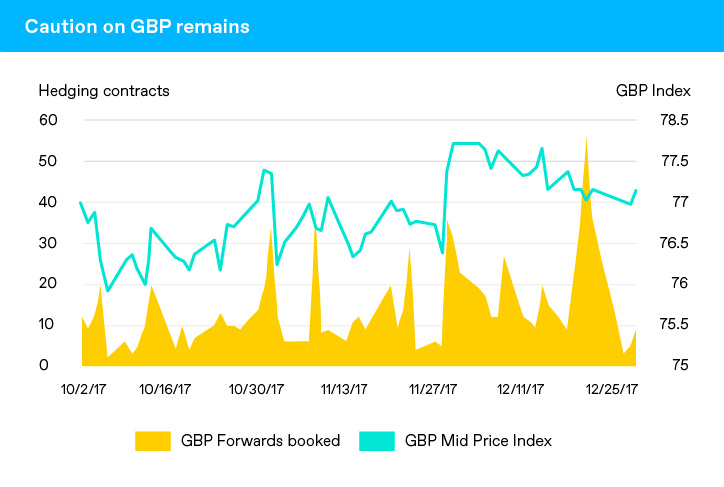

Cost pressures affect SMEs hedging behaviour

British SMEs remained keen to take advantage of short term spikes in the value of sterling when buying forward contracts in Q4. While this may seem obvious, it further suggests that importers are looking for any relative pricing advantage they can benefit from given high levels of factory gate inflation and the relative pressure it has put on margins.

Jeremy Cook comments: “While hedging data may suggest that it is business as usual for internationally focused SMEs, the truth is that the circumstances they are dealing with are incredibly tough. Short term spikes in sterling are leapt upon in a bid to offset higher input prices caused by higher energy costs and the legacy of the devalued pound while margins remain tight.”

ENDS

Methodology:

All figures, unless otherwise stated, are from YouGov Plc. Total sample size was 1,020 senior decision makers in small/ medium British businesses. Fieldwork was undertaken between the 5th and 13th February 2018. The survey was carried out online. The figures have been weighted and are representative of all British business sizes.

World First data on client contracts was collated between 1st October 2017 and 31st December 2017 and refers to UK corporate desk clients only.

About the Global Trade Barometer

World First’s Global Trade Tracker provides a unique snapshot of global trading trends across UK SMEs over the last quarter. By analysing World First’s corporate desk client behaviour and independent research surveying decision makers at more than 1,000 UK SMEs, the tracker looks at UK SME’s global trade behaviours over the last three months.