We have now updated our thoughts on NOK for the 2nd half of the year. These are below:

One of our better calls at the end of last year was that the gains in oil prices may not be sustainable and that the Norwegian krone looked vulnerable. In January we wrote that ‘a pick up in the oil price towards the end of 2016 has sweetened our end of year thoughts for NOK markedly but we have doubts on the sustainability of the oil price increase and therefore the expression of further krone gains next year’.

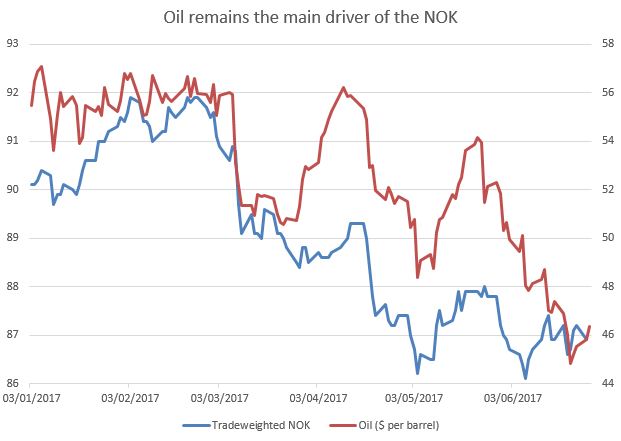

Source: Bloomberg

Hopes that the Norwegian economy could generate strong non-oil growth and an improving trade balance have not been come to pass and oil markets and the NOK have seemingly been joined at the hip in the first half of this year. We see oil as undervalued at current levels and, alongside increased expectations of rate hikes from the Norges Bank, a rebound of NOK in the second half of the year seems possible.

Conclusion: NOK could be one of the standout performers in the second half of the year.

A pick up in the oil price towards the end of 2016 has sweetened our end of year thoughts for NOK markedly but we have doubts on the sustainability of the oil price increase and therefore the expression of further krone gains next year. If, and it is an important if, the wider economy can generate strong non-oil growth and an improving trade balance then the NOK has the ability to outperform the European single currency although we would pick SEK as the winner within Scandinavia.

The Norges Bank will likely keep its policy on hold through 2017 absent a shock to oil markets or some form of financial market instability generated by the political furore in Europe or the US. We do think that the Norwegian economy may struggle to maintain the current levels of inflation through the coming few years and that will also weigh on NOK on a relative basis.

Want to learn more? Check out our full list of 2017 currency predictions or drop us a line to research@worldfirst.com with any questions.