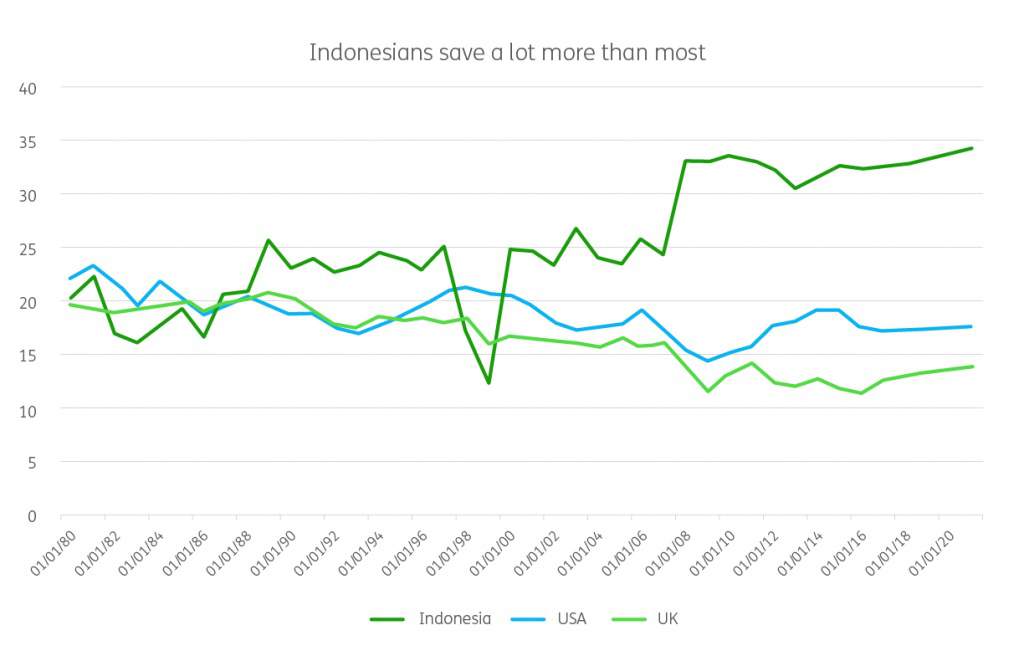

Much like India, we think that Indonesia displays few characteristics of a country that will be meaningfully damaged by a protectionist, anti-trade Trump presidency and a stronger US dollar. The Indonesian government and Indonesian businesses have drawn down their levels of USD borrowing whilst the average Indonesian maintains a decent level of saving from their monthly wage packets.

Of course, as we have said elsewhere in our 2017 Outlook, Trump remains a very much unknown factor – on trade in particular – and his desire to pursue aggressive reforms could easily peter out once he’s in office. Similarly, they could intensify with seemingly little encouragement or forethought.

Internally growth remains strong however and should continue to expand if expectations of an increase in commodity prices and exports become more realistic. Consumer spending will benefit in commodity focused areas of the country from this growth although we have to balance this against cuts in subsidies and an increase in tax enforcement stymieing spending my middle class consumers on larger items.

Under the rules of terms of trade, an improving commodity picture should paint an improving picture for a country’s currency. The rupiah had a volatile year in 2015 and 2016 has seen it calm down. Fears over the country’s current account – levels of exports vs imports as well financing in and out of the economy – have diminished while markets took the 150bps of cuts from the CB well. Higher investment inflows should be balanced out by higher commodity exports and hence we foresee a healthy current account ratio to remain in 2017. This will limit IDR volatility in our eyes and also insulate from Trump-ian impulses.

Want to learn more? Check out our full list of 2017 currency predictions or drop us a line to research@worldfirst.com with any questions.