We have now updated our thoughts on GBP for the 2nd half of the year. These are below:

The keenest discussion for the pound coming into the second half of the year is not Brexit but whether the Bank of England feels the need to raise interest rates anytime soon.

The dichotomy in wider markets at the moment is between near record levels in some stock indices and the growing chorus of policymakers advocating that the amount of stimulus the world’s central banks are pumping into world markets should come to an end. Currency is in the middle; with gains for the EUR and GBP especially as policymakers make noises that most had thought were not going to be heard for a while.

We must, as is our duty, inject notes of caution in to both the stories of a hawkish European Central Bank and a Bank of England eager for higher rates. Sterling has to be the most exhausting currency to analyse at the moment as both economic and political foundations feel more like tectonic plates constantly shifting under ones feet. Caught between the plates is the pound and much like anything under pressure only time will tell whether the forces are strong enough to crush it or force it higher.

For the moment economics is the main driver of sterling as last week yielded a fresh round of comment from policymakers about the potential of a Bank of England rate hike by the end of the year.

Having told us in the June Quarterly Inflation Report that the time for rate hikes was not yet here, he went on to say in a speech at an event put on by the European Central Bank that “some removal of monetary stimulus is likely to become necessary if the trade-off facing the MPC continues to lessen and the policy decision accordingly becomes more conventional.”

Having read through the entirety of his speech I do not think that this materially changes much of the stance of the Bank of England however a continuation of this language will obviously increase market expectations that a hike is imminent. The Governor has not turned into a policy hawk overnight and certainly there has not been a slew of above consensus, rebounding economic data that can easily allay the MPC’s wider concerns over pay, credit, growth and investment.

Secondly we have to look at where the pain is coming from for the MPC and that is inflation. Much like we as consumers the Bank of England lives and dies by inflation and with CPI at 2.7% and still likely to rise a little further some members of the rate setting committee are getting a little antsy. I therefore think that a speech that in the short term may generate a little bit of sterling upside and, more importantly, some two-way risk in the pound, may be enough to quell consumers’ inflation expectations in the short term. Similarly the desire for the Bank of England to keep at least some semblance of credibility in the pound as a currency cannot be underestimated either.

The Bank can’t raise rates to fight inflation given how high credit levels in the UK economy are but neither can it be seen to be doing nothing.

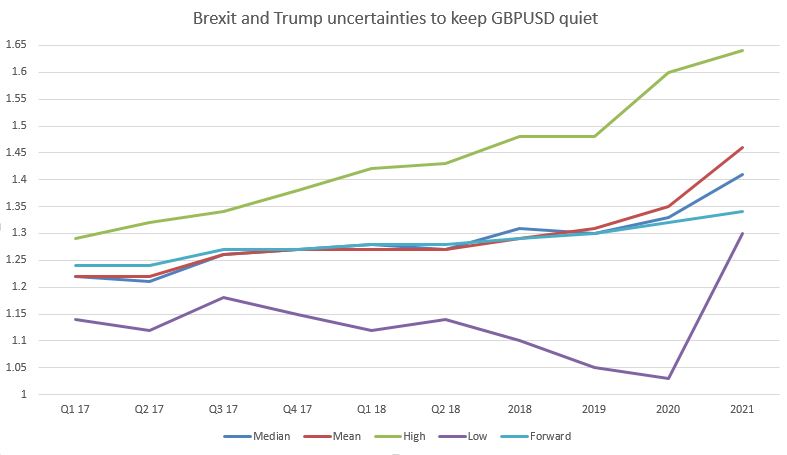

These predictions outline the high, low, median and mean expectations for the above currency pair as found by a Bloomberg survey of banks and brokers and should only be used for illustrative purposes. Source: Bloomberg

Brexit, following the triggering of Article 50 is now a chronic condition subject to acute periods of pain and will act as a depressant on sterling that will keep spikes from getting too flighty.

Conclusion: political hurdles will keep sterling weak as much as a slowing economy

For all the heat and noise from the referendum and the near six months that has passed since that morning in June, there are few things that we are more certain of than when the UK went to the ballot box. I know that Article 50 will be invoked by the end of Q1 in all likelihood and that will start the stopwatch on two years of negotiations.

Everything else is up for debate and, more pertinently, negotiation.

I was wrong in my assertions that the UK economy would immediately suffer as a result of the Brexit vote, but the economic data remains balanced on a knife edge. Heading into 2017 it is inflation that worries us the most.

Inflation will likely be the main, basic economic indicator of damage from the EU referendum vote, the triggering of Article 50 and the eventual separation of the UK from the EU and I believe that that pain will be held off until next year.

In my estimates, it will be the early part of the New Year that sees the majority of the price rises. Retailers have held off on price rises into Christmas but that will end soon. Of course, the tightness of budgets in the retail environment means that any price rises are going to be painful – and low cost operators and discounters will be ready to pounce – but they will have to come or we will likely see additional seasonal and structural unemployment increases in 2017. Even so, I cannot rule out an increase in unemployment through the year.

Growth will remain weak, while investment will remain stilted.

Business is all about margins and 2017 is likely to be a year wherein margins of British businesses are likely to be compressed and strangled. We are going to spend a lot of 2017 talking about inflation and the pressures that higher import prices are putting on businesses and latterly consumers. Businesses are going to have to deal with higher costs via imported inflation, weaker consumer sentiment and a labour market that is close to record employment.

Something will have to give; either the pound gains 15%, consumers load up on credit and keep the spending levels going or people start to lose their jobs.

We remain optimistic on the longer-term possibilities for sterling and the wider UK economy, but feel that 2017 and 2018, in all likelihood, will be a tough year for UK businesses.

Is sterling oversold? Absolutely. Does that mean that it cannot go any lower? Absolutely not. While the pound has only been weaker on a trade-weighted basis twice since the end of Bretton Woods, the nature of Brexit and its existential risk to the UK’s position in the world and its trading relationships across the globe arguably make for a more complicated policy cocktail than anything I have seen before.

I believe that upside to sterling will return, possibly by the end of the year, although this depends almost exclusively on an easy path of negotiations between the UK and the EU. I think it is therefore prudent to wait until the government has laid out its negotiating plan before becoming bullish on GBP.

It is also my belief that the Bank of England will not make any changes in policy to support the pound. Whilst inflation may run above target, Governor Carney at the most recent inflation report made it clear that the Bank was very much in a neutral stance and communicated that earlier guidance to cut interest rates further had ‘expired’. That language continued at December’s meeting.

Within his November statement, Carney emphasised the almost binary nature of the classical guidance problem that the Bank of England faces; higher inflation or fewer jobs. There is not much the Bank can really do right here; predictions will be picked over by either side of the referendum divide and with policy at record lows and its credibility being unfairly dragged through the streets, the Bank will sit on its hands and wait for the data to show it something more than higher inflation and lower growth.

The one bright spot for sterling may be its ability to keep its head above water against the euro given the political issues on the continent. Sterling has been used as a haven of late from issues within European politics.

Want to learn more? Check out our full list of 2017 currency predictions or drop us a line to research@worldfirst.com with any questions.