We have now updated our thoughts on AUD for the 2nd half of the year. These are below:

As with the New Zealand dollar (NZD), our view that AUD would dip towards 0.71 came within a whisker of coming to pass and ever since the AUD has been tired and in a range against the USD. The weakness of the USD following the realisation that Emperor Trump is wearing no clothes has prompted some AUD strength but the commodity complex remains very cautious.

As we stated at the beginning of the year, we do not expect 2017 to see any additional Reserve Bank of Australia movement one way or the other, save for cuts in the event of a reaction to some form of trade war between the US and China. The chances of this catalyst have diminished since the beginning of the year but, crucially, are not non-existent.

All in all we think that investors will choose to hold other commodity currencies – the NZD in particular – over the AUD through the second half of the year given the risks to Chinese growth and a lack of dependable wage pressures in Australia.

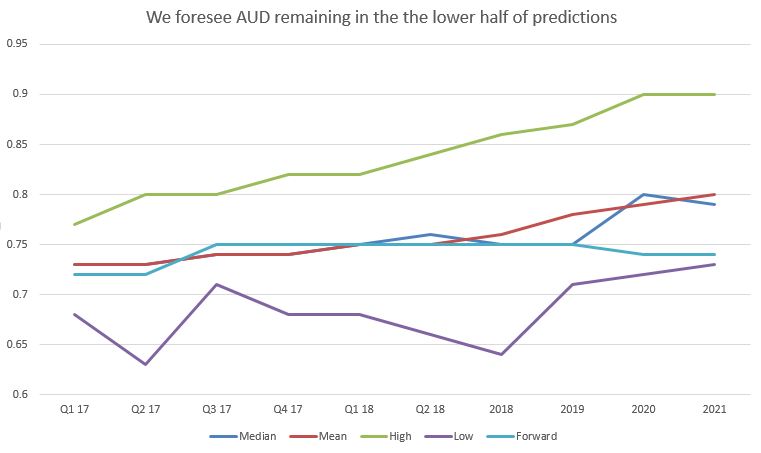

These predictions outline the high, low, median and mean expectations for the above currency pair as found by a Bloomberg survey of banks and brokers and should only be used for illustrative purposes. Source: Bloomberg

Conclusion: Data remains weak and we think the AUD will do too

We have more than a few concerns for the AUD and Australian economy going into 2017. We have been overly bearish on the AUD in the past but we now believe that the cyclical effect of the most recent runs of interest rate cuts are starting to lose their effect while the benefits of a slightly weakened AUD are not helping the trade balance as much as it used to.

We do not expect 2017 to see any additional Reserve Bank of Australia movement, one way or the other, save for cuts in the event of a reaction to some form of trade war between the US and China. The impulse that originally caused the RBA to embark on the now concluded cutting cycle – falling mining investment amid a collapse in global commodity prices – has largely passed and a pick-up in infrastructure spending will drive investment flows as a strong proportion of GDP in 2017.

Stronger commodity prices will lift incomes definitively in Australia but, as we have expressed in a number of our outlook pieces, we hold doubts over the ability of a meaningful and long lasting increase in commodity prices. Once again, the discussion comes back to China and its level of infrastructure spending as well as the noises coming from 1600 Pennsylvania Avenue.

Overall through 2017 we are looking for a decline in AUDUSD down to around the 0.71 mark with risks to the downside courtesy of the potentially negative evolution of President Trump’s relationship with the wider APAC region.

Want to learn more? Check out our full list of 2017 currency predictions or drop us a line to research@worldfirst.com with any questions.