Good morning,

Finally! An election that hasn’t got people running for the hills

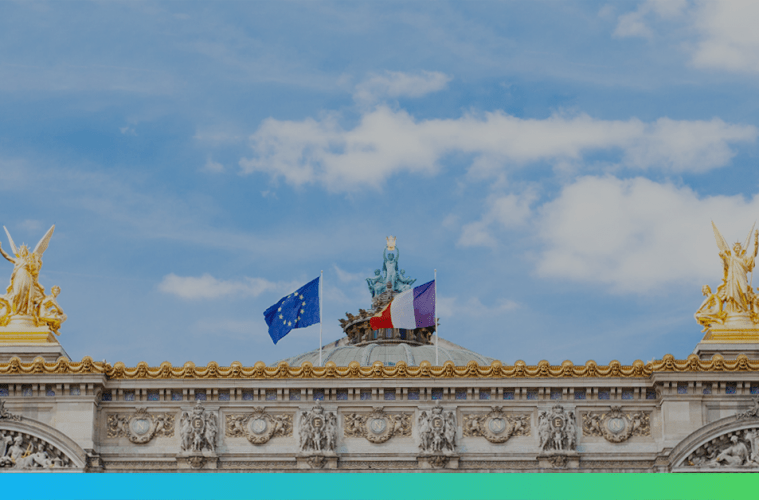

The result of the first round of the French presidential election is simultaneously a huge turn up for the books and what most people expected. For the first time in decades a member of the 2 main parties of French politics – Les Rebublicains and the Parti Socialiste – will not contest the 2nd round of the election with two outsiders taking on the fight for the Élysée Palace in the coming fortnight.

Emmanuel Macron and Marine Le Pen; centrist vs fascist, globalist vs localist, former banker vs former lawyer. The polls had it right from the off and the two biggest sighs of relief last night will have come from French pollsters and those holding the European single currency.

Euro benefiting but little more to come for now

EUR drove to a 5 month high against the USD as the results became clear last night with the single currency gaining against all comers. This positivity is mainly as a result that if there was one match up that the anti-EU Le Pen did not want in the 2nd round it is Macron. There has not been a poll that puts her within 15% of Macron in the 2nd round and so, save the most stunning failure of political polling in history, you have to think that Emmanuel Macron will be the French President in a fortnight’s time.

Francois Fillon and Benoit Hamon, the Republicain and Socialist candidates respectively, have both endorsed Macron and while there are issues over upcoming legislative elections in France in June and the longer term fears of how many voters (49%) backed a Eurosceptic candidate, in the near term the populists are licking their wounds and the euro is starting the week in a reverie.

We will be diving into the details of the 2nd round and the markets newfound focus on the European economy in our webinar on the French elections on Wednesday. You can register here or by following the link in the banner at the top of the Morning Update email.

GBP focused on Friday’s GDP announcements

Needless to say GBP has been one currency that has taken a knock against the single currency but remains strong against the USD; this is a euro story and not one of GBP weakness. Election news over the weekend was light although The Times’ splash on Saturday that the US would indeed prioritise a trade deal with the EU over one with the UK will not have gone down well on Whitehall.

The highlight for sterling this week is something altogether more parochial. The initial reading of UK GDP for Q1 is due Friday morning with estimates expecting to show that growth has near halved between Q4 of last year and Q1 of this year. A slowing of investment and consumer spending are the main culprits. Friday’s retail sales numbers showed that the first quarterly fall for 4 years. Spending on everything from department stores was lower and viewed through the prism of recent store closures by both Debenhams and Marks and Spencer, the second shoe to drop of the high price, low spending atmosphere has to be further wage compression and rising joblessness in the sector.

We used to think that when the going got tough, the Brits went shopping but this retail environment is too much for the hardy British consumer. The weakness in the pound will have afforded some cushioning effects for higher-end retailers who will benefit from tourists hell bent on a deal. For everyone else however the picture is one of weakness.

The day and week ahead

Today may see markets thinking that political risks are slipping but fears over further votes on healthcare in the US as well as more executive orders over the wall between the US and Mexico have raised the risk that the US government ‘shuts down’ later in the week.

Have a great day