There is no easy way to say this but 2019 could be a really difficult year for the MYR. Nearly a quarter of all Malaysian debt is held overseas and debt at a government level is nearly half of GDP. These are not strong fundamentals to start with.

Similarly, Malaysia is one of the most exposed Asian countries to China and any slowdown there, which we are expecting in 2019 will materially affect both Malaysia and its currency. One saving grace could be a move higher in commodities that would support exports and the country’s current account surplus.

That support may only materialise in the 2nd half of the year however and so, until then, the MYR will remain very exposed.

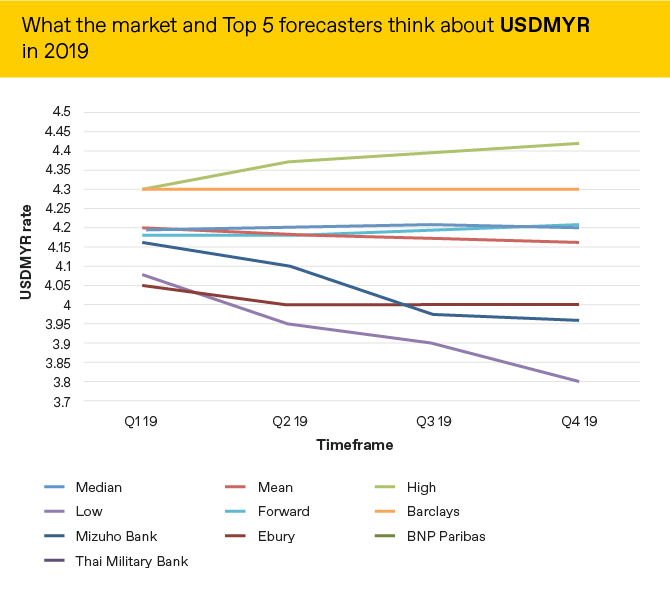

Market expectations of what will happen to the MYR versus the USD are below alongside the predictions of the 5 most accurate forecasters as measured by Bloomberg

Source: Bloomberg as at 27/12/18

The full list of our 2019 currency outlooks can be found here.