As we expected, the Indian rupee had a good 2018 and was protected from the broad swing of USD appreciation although we have to wonder whether this can continue into 2019. The Federal Reserve is likely to persist in raising interest rates in 2019 and we are also of the belief that the oil price will rise – a key pressure on the Indian economy, felt especially in the midst of President Trump’s increased sanctions on the Iranian state.

The first half of the year will also be subject to political risk ahead of an election in either April or May 2019. The ruling National Democratic Alliance and the opposition United Progressive Alliance will head off at the polls and we think that additional stimulus programs, put in place by the government in a pre-election bid for support, may be enough to draw attention to a weak current account and higher external financing costs.

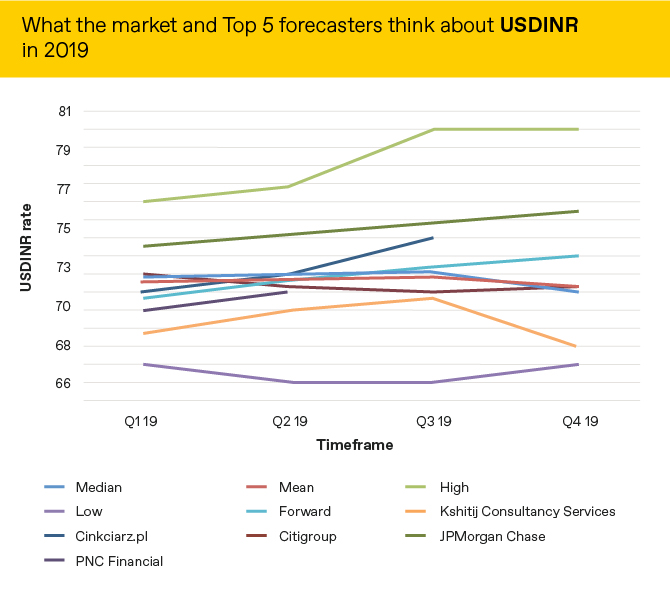

Market expectations of what will happen to the INR versus the USD are below alongside the predictions of the 5 most accurate forecasters as measured by Bloomberg.

Source: Bloomberg as at 27/12/2018

The full list of our 2019 currency outlooks can be found here.