The EUR will likely be the most important currency in the world in 2019 and how it, and the central bank that issues it, navigate the next twelve months will be both a symbol and a catalyst for global economic strength or a dark economic period.

Let’s start with politics as these have overshadowed the continent since the beginning of 2017. While the Dutch, French and, to a lesser extent, the Italian elections are now consigned to the history books, politics remain a significant risk to forecasts. European Parliament elections are due in May of 2019 and there is a lot more populist shoes to drop between now and the end of reactionary politics.

That being said, and as we have noted in our CHF outlook for the next 12 months the risks from the Italian, and latterly French, discord has been overdone and that a near-term deal on the Italian budget is well within reach and likely to see some risk come out of the EUR price as a result.

Similarly, we do not see Brexit ending in a no-deal, cliff-edge scenario that damages both the UK and wider EU. As we note in our GBP outlook, there is enough political will on both sides of the Channel to prevent it occurring with the UK likely to postpone the end of the Article 50 period by a few months.

These idiosyncratic factors, whilst important, should lessen in impact as the year goes on to the single currency’s favour.

Our belief is that the European Central Bank will raise interest rates in the summer of 2019 with a plan to continue hiking rates and winding down stimulus on a gradual basis that should even out to around one 25bps increase every 6-9 months. Such a move is contingent on stability in economic data – that is lacking at the moment – and calm financial markets; we expect growth to bounce back in 2019 following a weak year in 2018 although global trade concerns may hurt things at the margin.

With the ECB hiking interest rates and the Fed likely reaching a top in their hiking cycle within the next 12 months we think both EURUSD and EURGBP will perform well in 2019.

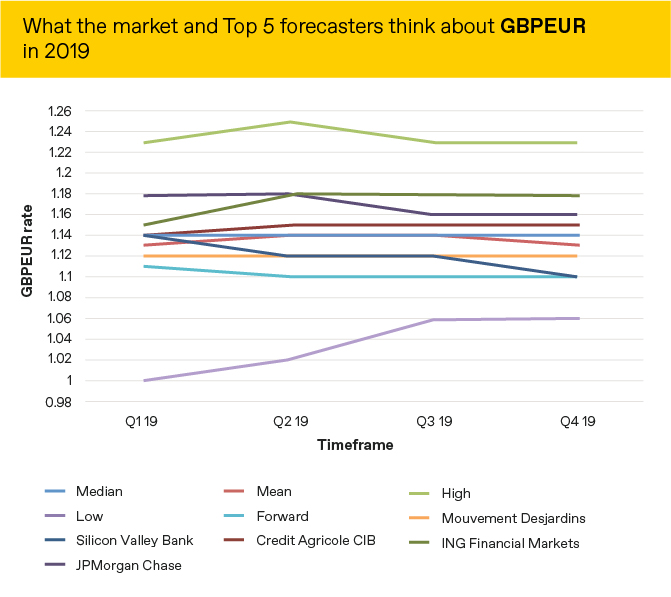

Market expectations of what will happen to the EUR versus the GBP are below alongside the predictions of the 5 most accurate forecasters as measured by Bloomberg.

Source: Bloomberg as at 27/12/2018

The full list of our 2019 currency outlooks can be found here.