The yuan is ending 2018 well with the currency benefiting from a temporary ceasefire on trade and the slight softening of expectations as to by how much the Federal Reserve can stand to raise interest rates in 2019.

We have to think that the good times will not last however and weakness in the Chinese yuan will come through in the early part of 2019 with the Lunar New Year celebrations as always providing a useful Rubicon for investor sentiment.

There is little expectation in markets for a quick and succinct conclusion of trade concerns between the US and China and indeed we, alongside the consensus, expect concerns, tariffs and non-tariff barriers to increase in the first half of the year.

We also expect to see a continuation of the pressures on the Chinese economy with lower corporate profitability, a weaker manufacturing sector and increases in unemployment. Certainly, the biggest risk to our forecasts is that the Chinese economy may outperform expectations of growth decelerating to 6.0-6.2%.

The People’s Bank of China and other Chinese authorities will continue their own individual easing policies in 2019, limiting the amount of support that the CNY/CNH may be able to count on. The authorities have a tough needle to thread however with a balance needing to be struck between stimulus and promoting external stability. Overly stimulating the economy risks overly large losses in a currency prone to outflows, regardless of the strength of controls to prevent such events.

Some of the devaluation will be kept in check by Europe; as Europe recovers and markets begin to further price in additional interest rate hikes, the euro may be able to temper the chances of a strong dollar smacking CNY and other emerging market currencies around too much. If that European strength doesn’t emerge then there could be some real fireworks in the USDCNY exchange rate.

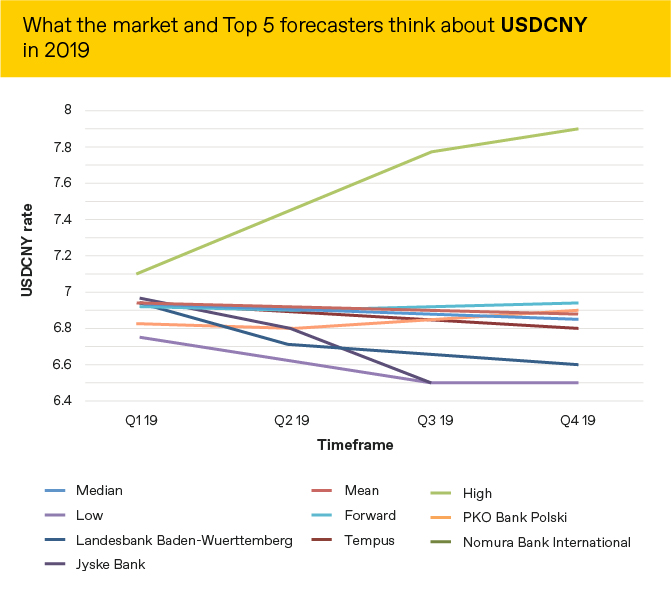

We expect USDCNY to trade towards 7.10 over the course of 2019.

Market expectations of what will happen to the CNY versus the USD are below alongside the predictions of the 5 most accurate forecasters as measured by Bloomberg.

Source: Bloomberg as at 27/12/18

The full list of our 2019 currency outlooks can be found here.