“Tis impossible to be sure of anything but Death and Taxes”. Originally written 300 years ago, Christopher Bullock’s words still ring true today. But, where there’s tax, there’s usually spending. We’ve had a look at HM Treasury’s spending figures to see where your money goes, and how that’s changed over the years.

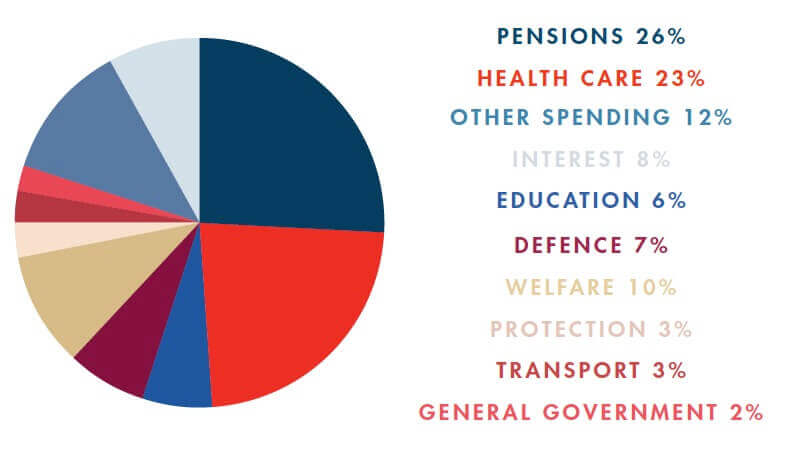

By a considerable distance, the single largest destination of tax money is servicing the state pension scheme. In 2017, we’re expected to put over £150 billion into the country’s pension pot, helping keep pensioners afloat after the government’s designated retirement age. This is closely followed by healthcare, which sees close to £140 billion in spending per year. These two costs combined make up just shy of half the government’s total spending bill and will both need further funding in the future due to the UK’s ageing population. What is possibly more telling for the future of the UK’s economy is how we’re funding government departments. Unsurprisingly, the NHS and state education departments receive the lion’s share and this should remain the case in the near future, with their budgets expected to rise by 25% and 19% respectively in 2020.

By a considerable distance, the single largest destination of tax money is servicing the state pension scheme. In 2017, we’re expected to put over £150 billion into the country’s pension pot, helping keep pensioners afloat after the government’s designated retirement age. This is closely followed by healthcare, which sees close to £140 billion in spending per year. These two costs combined make up just shy of half the government’s total spending bill and will both need further funding in the future due to the UK’s ageing population. What is possibly more telling for the future of the UK’s economy is how we’re funding government departments. Unsurprisingly, the NHS and state education departments receive the lion’s share and this should remain the case in the near future, with their budgets expected to rise by 25% and 19% respectively in 2020.

The departments getting the biggest boost to funding will be the Cabinet Office and Intelligence, which are seeing spending rises of 45% and 31% up to 2020. Nonetheless, these spending gains are often countered by cuts elsewhere and the biggest budget victims are set to be the departments of Justice, Foreign & Commonwealth and Transport who are to see funding drop by 35% on average.

Note: all figures and statistic cited are courtesy of HM Treasury’s PESA estimates.

This article is part of our spring edition of Transfer magazine. Download your complimentary copy here.

Further reading:

Inflation focus: five things that have gotten much more expensive and why

Will we see a recovery in Europe this year?