Good morning,

Despite the lack of a Brexit deal and the new restrictions being put in place to thwart the new strain of Covid, the pound made a remarkable recovery during the Asian trading session. After hitting a low of 1.3188 against the dollar, the rebound has seen the rate notch up to 1.3432, at the time of writing, totalling a 1.88% increase. Against the euro, the recovery stood at 1.35%, to leave the pair testing the 1.10 mark again.

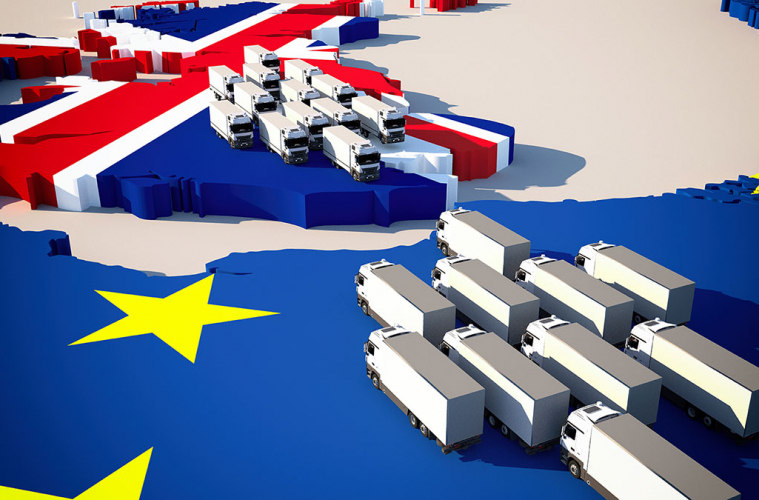

Various outlets are now reporting that a compromise on fisheries is edging closer, with concessions being made on both sides. The EU quota to UK waters after the 1st of January and the length of the transition is said to be the main point that the two sides are going back and forth over. Reports seem to suggest that the other two key issues of governance and the level playing field may have been agreed upon.

Despite these developments, the markets have cooled their interest in the new restrictions put in place to areas of the UK. Sir Patrick Vallance, the UK’s top scientist, has warned that more areas could have to enter into the tighter tier 4 restrictions, as the new strain of Covid is “everywhere”. Therefore, there is a predicted to be a surge in cases following Christmas, due to the “inevitable period of mixing” between family members.

With thinner liquidity in the market throughout the festive period, GBP pairs, in particular, are open to sudden and sharp movements, especially with new Covid-19 developments. If you are closing for the Christmas break, please reach out to your account manager to mitigate any risk whilst your out of office is set.

Have a great day ahead.

Jack Nicholls, Relationship Manager.

Whilst every effort is made to ensure the information published here is accurate, you should confirm the latest exchange rates with WorldFirst prior to making a decision. The information published is general in nature only and does not consider your personal objectives, financial situation or particular needs. Full disclaimer available here.

| Speak with our friendly staff to see how you can receive the best rates on your investments | |

|---|---|

| Contact us via phone, email, or live chat |