Don’t take your eye of the growth story

We’re ending the year as we began it; with political risk in the Eurozone. While the impacts of the Dutch and French election have petered out, the lack of a government in Germany, elections in Catalonia and Italy and the risks of a cliff-edge Brexit still need to be boxed off before all of the risk can be filed away.

The European economy has been the standout success story of the year and while some business confidence surveys are hitting record levels, and therefore invite the belief that the business cycle may be rolling over in 2018, we are more confident. There is still a vast amount of slack that needs to be taken up in the Eurozone economy – EZ unemployment remains at 8.8% against circa 4% in the UK and US – and alongside an unsure inflation outlook this should allow the ECB to cautiously keep monetary policy loose and growth running in the right direction.

The European Central Bank’s latest policy meeting saw them keep benchmark interest rates unchanged (no surprises there) while they slowed down the pace of their asset purchase program. From January 2018, the ECB will buy €30 billion per month in corporate and government bonds, down from the €60 billion per month they currently buy.

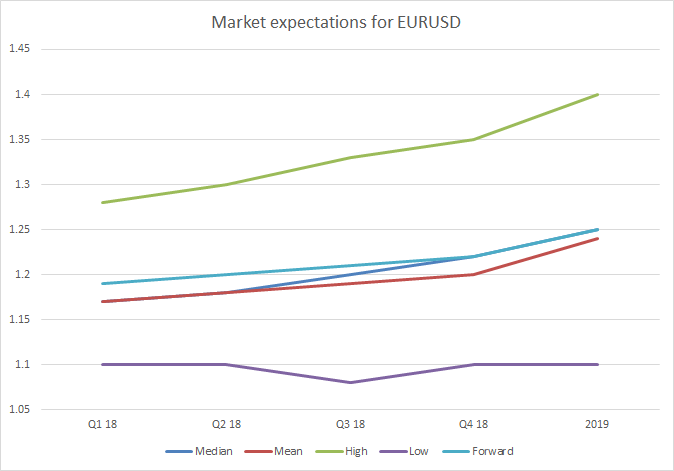

How this policy matures will depend on the weight that the ECB’s Governing Council can put in the belief that inflation is at a stable and sustainable level. If we start the year and inflation is behaving itself and is accompanied by an acceptable level of wage pressure then we see that by Q3 that the ECB’s QE program could be ended. The ECB has said that it will not raise rates until we are “well past” the end of asset purchases and some clarification on that will help cement rate expectations and, in our view, EUR strength.

EURGBP is still the ‘Brexit cross’ and therefore more susceptible to the whys and wherefores of the negotiation process than other crosses. We like the euro stronger coming into the end of the year on a continued strong growth profile but the central bank will want to see inflation drive higher as well.

Source: Bloomberg