Back to Black

As we have highlighted in our Global Overview piece ‘Local and Abroad’ the greatest risk that we see overhanging the global economy relates to China although it is almost certain to not be started by Beijing.

The trade flows between China and the US are the largest in the world and while the level of the trade balance is not going to materially change anytime soon the headwinds to developments of a positive manner are strong. Investigations launched this year on matters such as property rights will be resolved in 2018 and will, if recent events are anything to go by, be accompanied by a slew of antagonistic communications from the White House.

At home the balancing act of maintaining the current investment plans in infrastructure have to be balanced with the desire to deleverage the economy. We see Chinese businesses growing their investment spending with the Chinese consumer also taking on more spending as the middle class grows. Manufacturing production numbers may look like they are weakening as the industry comes to terms with new environmental legislation.

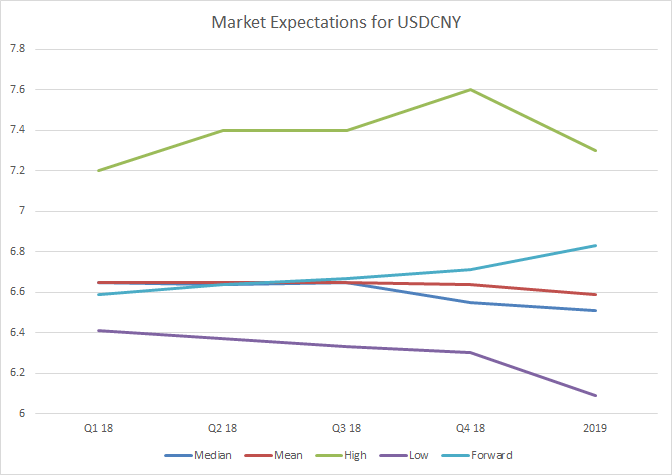

As we end the year the yuan is continuing to weaken following a summer of strength. It was artificially weak at the beginning of the year over fears around Trump trade policy and strong in the summer as the People’s Bank of China strengthened it ahead of the Communist Party’s Annual Congress. With that now out of the way the PBOC is undoing some of that strength and we think that USDCNY could easily drive as high as 6.80 through Q1.

Source: Bloomberg