We have now updated our thoughts on CHF for the 2nd half of the year. These are below:

Not much happened for the Swiss franc in the first half of 2017 and, in truth, very little is expected over the second half of the year either. The Swiss franc stepped lower twice against the euro over the course of the end of April as it became clear that Emmanuel Macron would win the French election and a lot of the electoral risk evaporated.

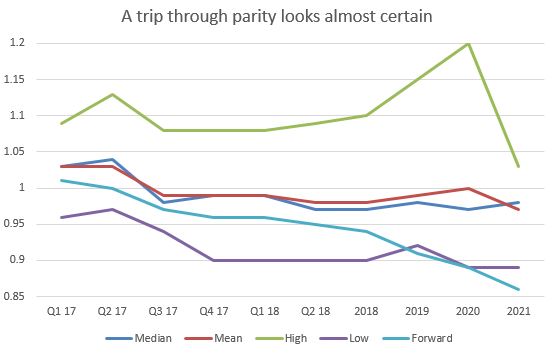

Our belief that the euro could be a standout currency over the rest of 2017 means that we see further weakness for the CHF in the near future; something that the Swiss National Bank is not going to get in the way of. These gains will likely be modest however and EURCHF seems likely to gain by around 2% only from current levels.

These predictions outline the high, low, median and mean expectations for the above currency pair as found by a Bloomberg survey of banks and brokers and should only be used for illustrative purposes. Source: Bloomberg

Conclusion: CHF will likely pull weaker as EUR comes higher

The great Swiss franc swings of yesteryear seem a lifetime ago as the currency has remained defiantly stout and resolute regardless of the winds that have blown against it. The Swiss National Bank’s policy of keeping the franc weak is very much still in play however we expect that pressures within the Eurozone will cause EURCHF to allow for additional CHF strength.

The Swiss economy is certainly looking healthier than it did 12 months ago with improvements in export performance and investment spending and it is not out of the realms of possibility to think that consumer spending will extend itself in the coming year as well.

This, plus the likely political pressures that have the potential to run riot in 2017, should push EURCHF towards 1.05 in the next 12 months.

Want to learn more? Check out our full list of 2017 currency predictions or drop us a line to research@worldfirst.com with any questions.