We have now updated our thoughts on ZAR for the 2nd half of the year. These are below:

It’s only fair to admit that our expectations for the South African Rand in 2017 back in January were distinctly incorrect. Despite correctly calling that South African debt would be downgraded to junk status by one of the major ratings agencies – Fitch having done this on April 7th – the rand has actually been one of the top performing major currencies of the year.

The reason for this is not through a misread of the South African rand however, but more a result of a miscalculation of the US dollar. As the graph above shows the movement of the USD as trade weighted currency and the movement of USDZAR confirms that the principal agent of the volatility has been the greenback and not the rand.

As we have noted elsewhere the impulse of the Trump election could not be maintained following his inauguration and a recovery in USDZAR back to where it started the year is only likely to happen should the White House be able to meaningfully advance its policy agenda on healthcare, tax and regulation. We and the market remain open to that idea but at a slower rate of appreciation.

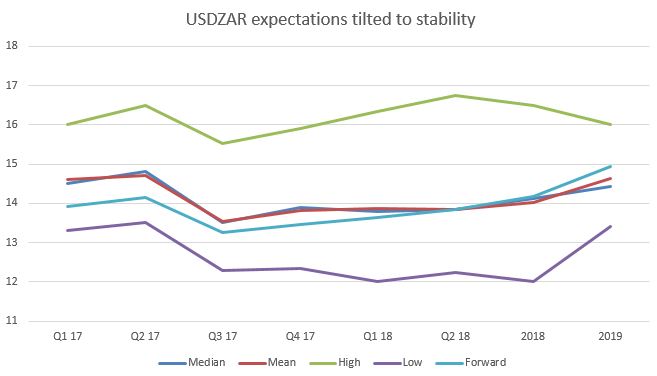

These predictions outline the high, low, median and mean expectations for the above currency pair as found by a Bloomberg survey of banks and brokers and should only be used for illustrative purposes. Source: Bloomberg

Conclusion: Washington is more important for the ZAR than Pretoria.

For as long as I have been in currency the ZAR has been basket case and we do not see 2017 being the year that this reverses. That being said the ZAR has exhibited some backbone this year. Unfortunately, comments from board members suggest that the cycle of interest rate hikes that the South African Reserve Bank has been employing has come to an end and although a shift to neutrality may be enough to keep the ZAR steady, any hints at interest rate cuts will see investors take on the rand.

We have to say that we do not expect cuts to come however. Inflation expectations are only heading one way and risks to the upside come from local issues such as political problems and continual poor electricity and utility delivery. Similarly, international factors such as a strong US dollar born of rising interest rates expectations and possible fiscal stimulus will drive thoughts of higher costs.

Growth will remain weak in 2017 and any improvement will likely emerge from cyclical factors and not structural improvements, which while promoting output now will do little to engender any longer-term developments. In this case, we think that falls in food prices may allow for further consumer spending increases but the average South African household is continuing to whittle away at already low savings levels.

The conversation over ratings agencies has died off in most economies but for some emerging markets – South Africa, Turkey, Malaysia – we have to be wary of their moves in 2017. There is a definite feeling in markets that South African debt could be rated at ‘junk’ by one or more of the large ratings agencies in the next 12 months which would provoke further political issues internally, including a possible new Finance Minister.

We expect USDZAR to drive higher towards 16.00 through 2017.

Want to learn more? Check out our full list of 2017 currency predictions or drop us a line to research@worldfirst.com with any questions.