We have now updated our thoughts on NZD for the 2nd half of the year. These are below:

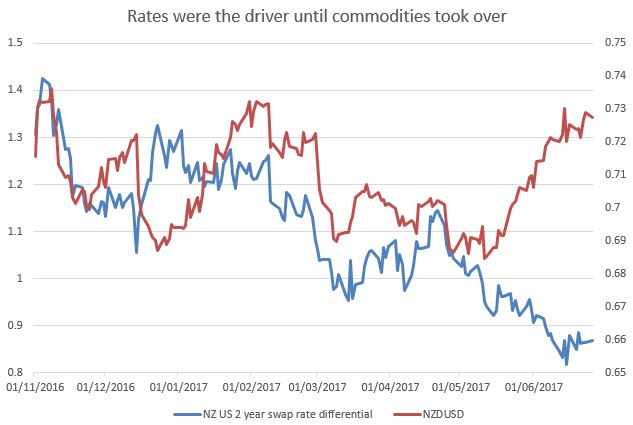

The place to look for impact on the New Zealand dollar since the beginning of the year has been the tightening of rate differentials between the US and New Zealand. In fact, since the US election the differentials between US and New Zealand interest rates over a two year time period have fallen by about a third. While data from the Kiwi economy has been strong, the market chose to jump on the USD train that the Federal Reserve has been driving since December.

The graph also shows a fairly decent rebound for NZD in May as global dairy prices recovered. A coincidence of this with increased inflation pressures in the country could drive the NZD back to 0.7500 in the short term, especially if the Reserve Bank of New Zealand are happy to allow the New Zealand dollar a little room to run. China’s deleveraging remains a risk for all commodity currencies of course, and unfortunately NZD could be tarred with the same brush.

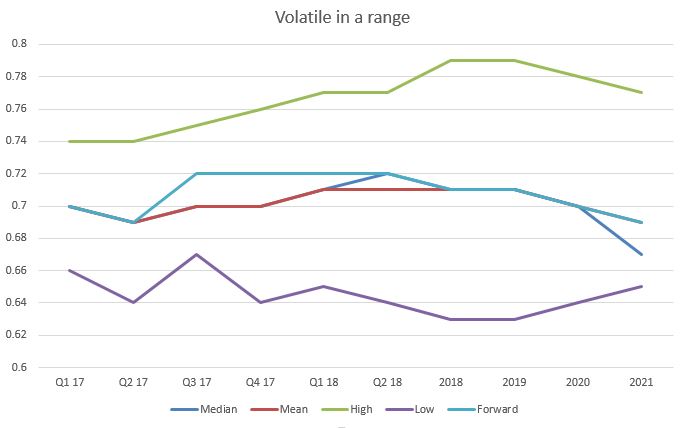

At the beginning of the year we set out a target of 0.6750 – we came within a cent of that – and while our expectations have shifted a little higher, the drive has not been aggressive and we would foresee the pair ending the year around the 0.70 mark.

These predictions outline the high, low, median and mean expectations for the above currency pair as found by a Bloomberg survey of banks and brokers and should only be used for illustrative purposes. Source: Bloomberg

Conclusion: The RBNZ may allow the dollar a little upside but gains are likely to be minimal.

New Zealand continues to battle a stubbornly high currency and that fight will continue with relatively little success in 2017. The November Monetary Policy meeting of the Reserve Bank of New Zealand hinted at further intervention and a possible rate cut in 2017 but even with markets increasingly of the opinion that this will emerge, the kiwi dollar remains strong.

Local construction spending will be both a growth and inflation booster next year. Whilst the most recent spate of earthquakes was nothing compared to those in 2011, we expect a positive impact on growth from the rebuilding effort. On the other side of the construction coin, the ‘bubble-like’ conditions in the housing markets remain a very real concern and are a definitive barrier to further monetary policy easing.

Going into 2017 we estimate that the NZD is around 12% overvalued against the US dollar and while we look for this overvaluation to lessen as the year goes on, this will be gradual at best. Rising bond yields in the US on the back of increasing inflation and stimulus expectations have reduced the attractiveness of holding higher yielding debt such as New Zealand’s. This is not a great concern in the grand scheme of things but will lend a hand in weakening the NZD.

As with its Antipodean counterpart, NZD and the New Zealand economy as a whole will always be viewed through a sphere of Chinese growth and influence. Greater volatility in China means greater volatility Down Under and while greater infrastructure spending in China will help matters it will not be able to guard against all of these depreciatory factors.

We are looking for a slow decline in NZDUSD towards 0.6750 in 2017 with risks to the downside should Chinese growth disappoint or the RBNZ decides to further take on the NZD’s persistent overvaluation.

Want to learn more? Check out our full list of 2017 currency predictions or drop us a line to research@worldfirst.com with any questions.