8MIN READ

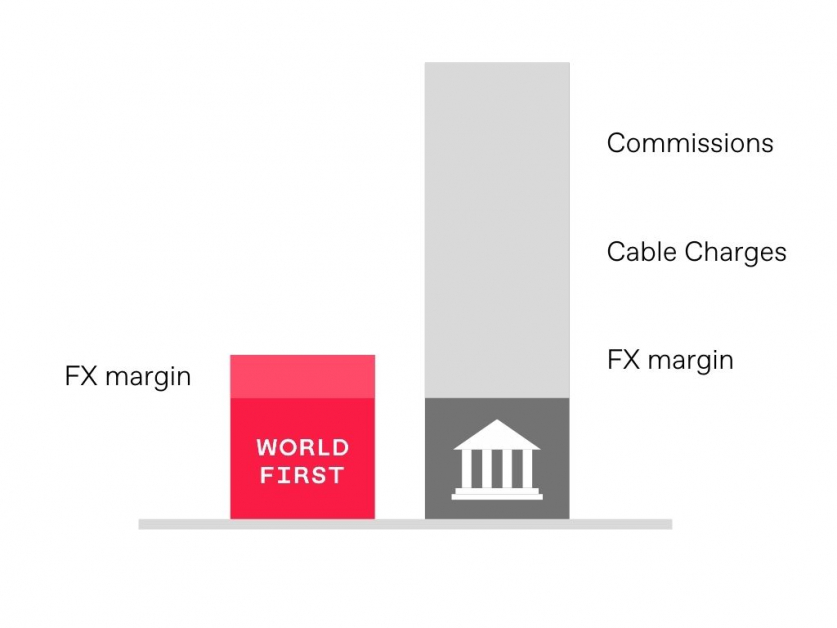

Businesses using banks for cross border payments could lose thousands of dollars yearly through hidden bank fees. Some exporters, importers and wholesalers have enjoyed great savings by using cross border payment specialists to collect funds and make overseas supplier payments. Here’s why:

The real cost of cross border payments with banks

1. Hidden transfer fees

Banks often charge a mark-up from the real exchange rate (the rate you see on Google). Some international payment specialists can be up to six times cheaper than banks. All you need is some due diligence to save when making cross border payments:

Tip 1- Compare the exchange rate you receive from your provider against the interbank bank rate (the exchange rate you see on google).

Tip 2 – Check with your international payment provider on all kinds of fees before making your transaction.

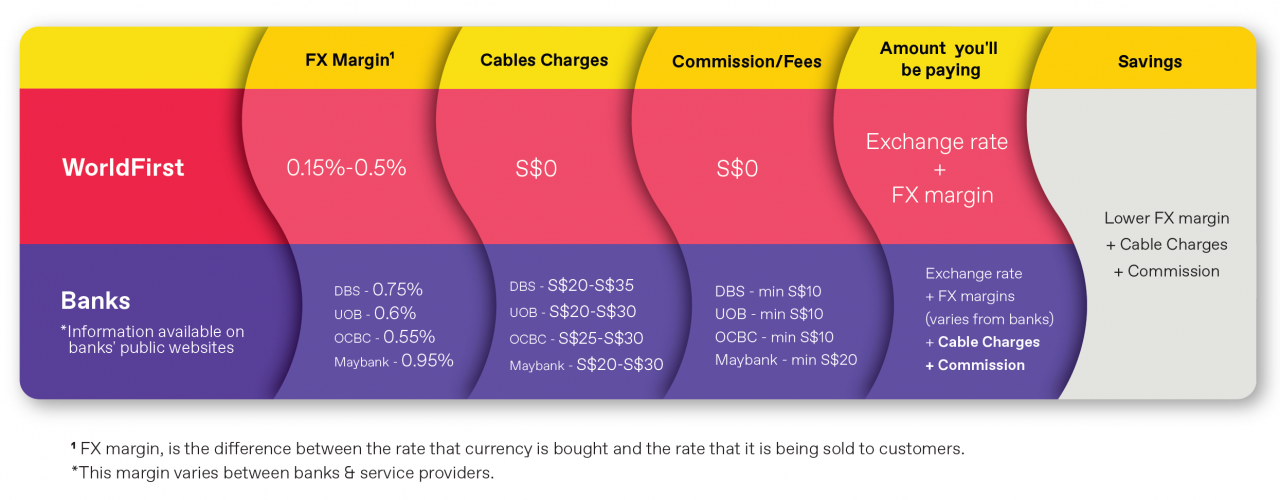

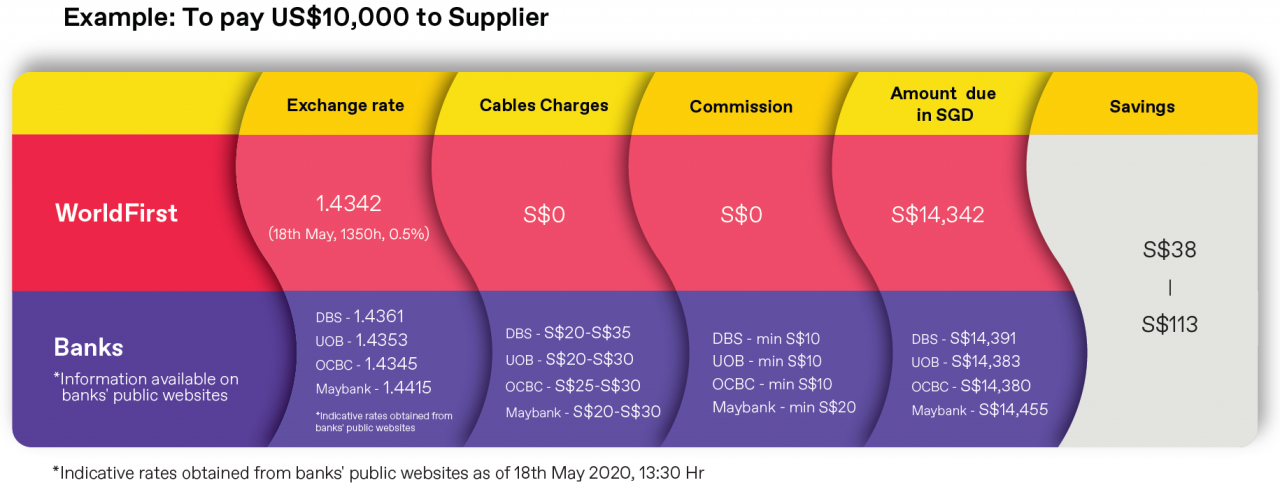

What Singapore banks are charging compared with an international payment specialist:

For example, an SME paying overseas supplier could save between S$38 to S$113 from one overseas transaction.

2. Account maintenance (annual fees, minimum deposits)

Although most businesses in Singapore are required to set up a bank account, not all business transactions need to be settled with a bank. Instead of making cross border payments with a bank, consider an MAS licensed payment provider to make your foreign currency payments. It may look easy to transact through a multi currency bank account but bear in mind the minimum deposit requirements, set-up fess and monthly service fees.

Comparison for foreign currency providers: Table updated 29 July 2020

Table updated 29 July 2020

To top it off, SMEs tend to be underserved by banks. If you face any transaction issues, such as payment delay or sending wrong beneficiary details, a service provider with responsive customer support or good tech should solve your payment issues.

Why make the switch to an international payment specialist?

With the hit from Covid-19 pandemic, the trade wars and inevitably Singapore’s trade reliant economy, B2B businesses will become more vulnerable to global trading environment. A June 2020 survey on Singapore businesses indicate longer B2B payment terms and a hike in business insolvency this year. This reflects a time of strained cash flow coupled with exchange rate pressures for small businesses.

Although trade credit and government stimulus packages are short term financial support for businesses, it’s time to consider a future proof strategy to maintain your cash flows and scale your business.

A easy and cheap way – World Account for businesses

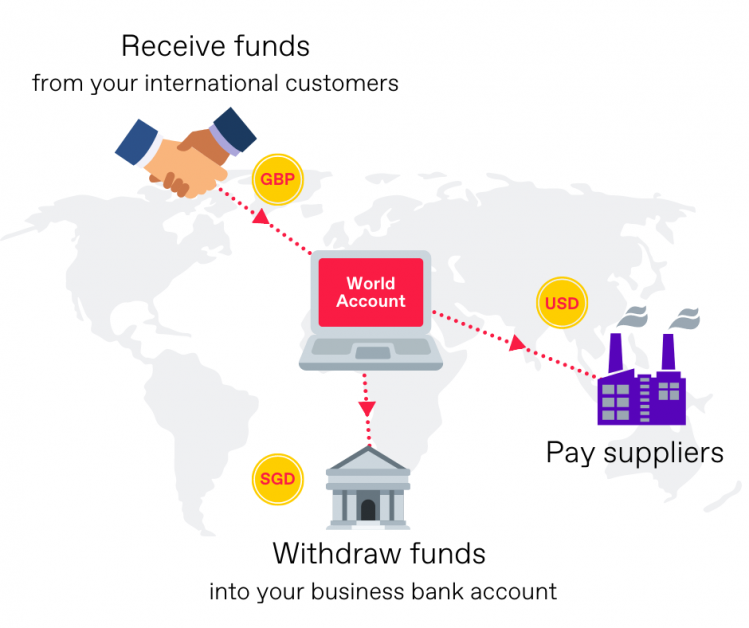

If you have many international buyers and sellers, businesses can benefit with World Account (a multicurrency virtual account):

- No set-up fees

- No annual fees

- No minimum account deposits, to ease your cashflows

- Avoid double the conversion fee

WorldFirst offers a margin of 0.5% or less based on your annual trading volume.

How to get a World Account?

- Register for a free World Account online.

- Suitable for business owners and online sellers selling on verified marketplaces or own a web storefront

- We just need a few documents to verify your business.

- Sole-trader – non-ACRA/ individuals doing eCommerce (Your ID required) OR

- ACRA business (ACRA documents, Directors’ and Shareholders’ ID proof required)

- Upon verification online, you’ll receive a dedicated account manager as well as currency bank details for all the currencies you may require.

- Start using World Account

- Deposit SGD from your bank via FAST transfer into your SGD currency account

- Share your currency account details to collect overseas funds from customers

- Add beneficiary and make overseas supplier payments

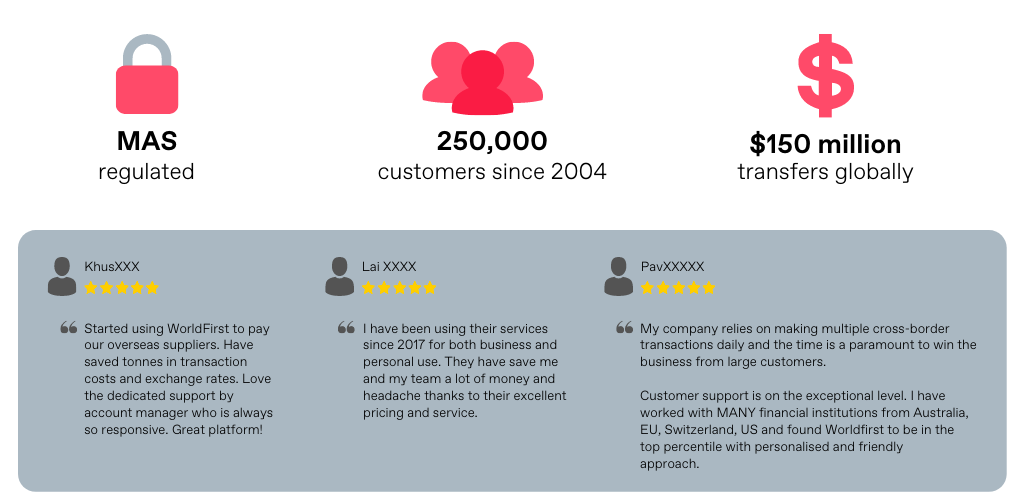

What other businesses say about WorldFirst Read more WorldFirst reviews on Seedly.

Read more WorldFirst reviews on Seedly.

Sources used in this article:

- DBS Corporate Multicurrency Account, corporate bank fees

- UOB Global currency account and fees

- OCBC Business Multi-currency account, OCBC Corporate bank fees

Disclaimer:

These comments are the views and opinions of the author and should not be construed as advice. You should act using your own information and judgement. Whilst information has been obtained from and is based upon multiple sources the author believes to be reliable, we do not guarantee its accuracy and it may be incomplete or condensed.

All opinions and estimates constitute the author’s own judgement as of the date of the briefing and are subject to change without notice. Please consider FX derivatives are high risk, provide volatile returns and do not guarantee profits.

*Although WorldFirst has prepared the Information contained in this website with all due care and updates the Information regularly, World First does not warrant or represent that the Information is free from errors or omission.

Read full disclaimer here