Fed deviates from ‘patient’ policy

As anticipated, Fed Chairman Jerome Powell stated that “in light of muted inflation pressures and increased uncertainties we now emphasize that the committee will closely monitor the implication of incoming information for the economic outlook and will act accordingly to sustain the expansion.”

They have also observed that the economy is ‘rising at a moderate rate’ in June and that inflation indicators have fallen. These call for a monetary easing and brings the odds of a rate cut in July to a 100%. Powell has also indicated that the ongoing trade wars and economic sentiment will play an important part in influencing rate decisions.

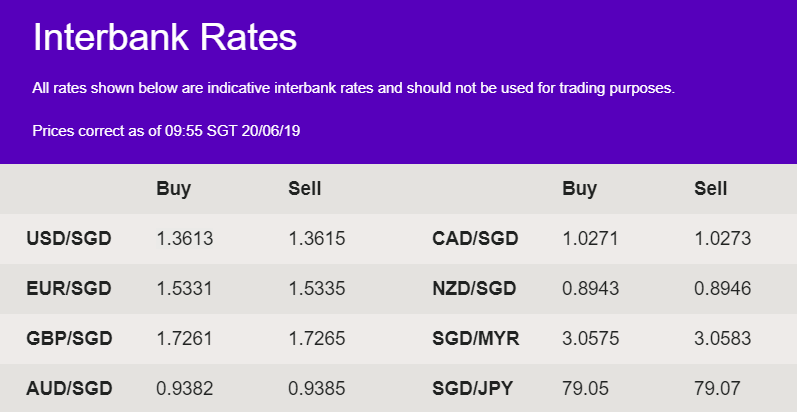

USD sank against the SGD by 0.26% yesterday and interbank rate is currently trading at 1.361 level.

BoE overshadowed by election

The Bank of England (BoE) will be delivering its monetary policy statement today at 7pm (GMT +8:00). However, as the election closes in to the final two candidates, the Sterling might be swayed by the leadership race more than anything. Market is not expecting any changes to interest rate this evening, given the uncertainty within UK itself and the lacklustre economic outlook globally. GBP/SGD currency pair rebounded yesterday by 0.42%.

Disclaimer: The above comments are only our views and should not be construed as advice. You should act using your own information and judgement. Although information has been obtained from and is based upon multiple sources the author believes to be reliable, we do not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute the author’s own judgement as of the date of the briefing and are subject to change without notice. Error & omission excepted.