Trade War with China, now a Long Term Problem

Greenback rallies ahead of GDP data

With no significant data out from the US until tomorrow’s prelim GDP q/q figures due at 8.30pm (GMT +8:00), investors’ attention remains dialled in on the trade war and its effects on global markets.

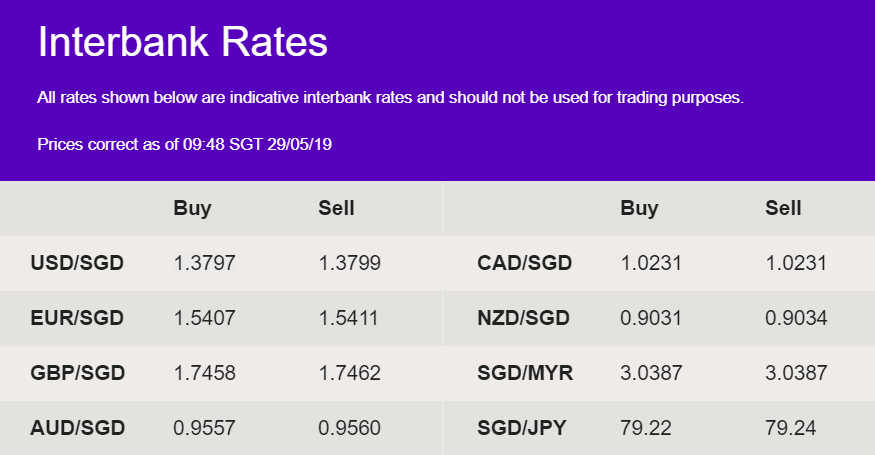

The danger of the US continuing down its tariff warpath, is that it could easily ignite something similar with Europe. The further it intensifies, the more it destabilises the global economy and the more capital flows to the US which in turn strengthens the US dollar. USD/SGD pair rose by 0.31% yesterday and continues the upward climb currently.

Brexit war worsens

Sterling has started the week within touching distance of the lows that it made last week as Westminster ripples turned into waves of pain for the Pound. The news remains that we are now looking at two scenarios for Brexit – a revocation of Article 50 following a 2nd referendum or a No-Deal Brexit that becomes policy either under a new Conservative PM or simply on the basis that Westminster can’t get anything agreed by the end of October.

As we have noted before, the impact on Sterling is not to see huge chunks of value taken out of it on a daily basis but more that investors will prefer to back other currencies well before they look at the Pound such is the political farce that governs the currency’s trading.

Disclaimer: The above comments are only our views and should not be construed as advice. You should act using your own information and judgement. Although information has been obtained from and is based upon multiple sources the author believes to be reliable, we do not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute the author’s own judgement as of the date of the briefing and are subject to change without notice. Error & omission excepted.