Disappointing Data Drive USD Downwards

Mexico Tariffs Indefinitely Suspended

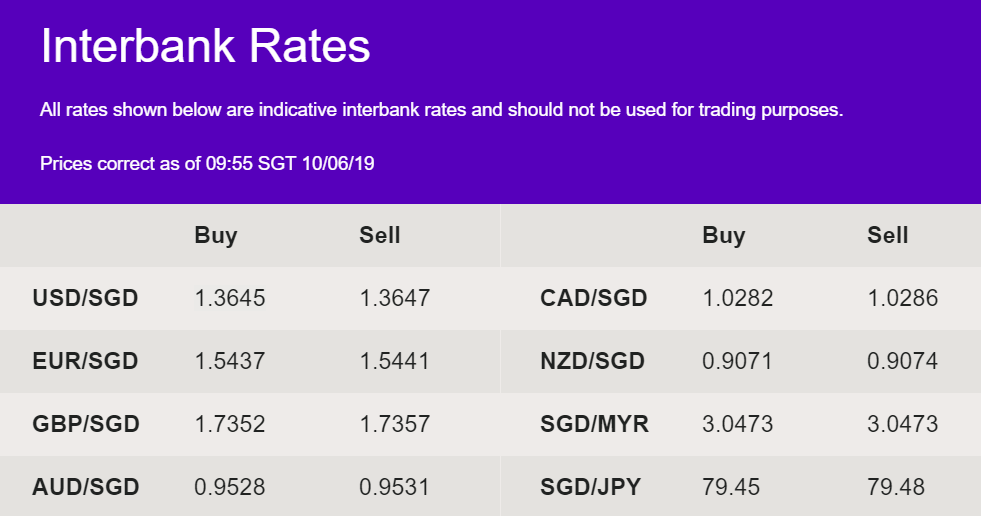

USD slips 0.15% against SGD last Friday as market prices in the certainty of a rate cut. While unemployment rate remains at 3.6%, non-farm employment increased only by 75K, in comparison to the forecasted 177k. Wage increments cooled as well, these data revealed a slowdown in US economy and prepare for the widely expected rate cut in July as Fed takes a data-dependent approach. Fed is also tracking the trade war closely – while Trump has declared an indefinite suspension on Mexico tariffs, decision on China still has not been made. USD/SGD is currently at the 1.36 interbank level.

Brexit on sideline as leadership race starts

Brexit negotiations take a back seat as the race to replace Theresa May begins – Candidates for the leadership position enter today and the party is expected to have a month to decide on the new leader for the country. Pound may be susceptible to volatility through this period as party members choose who to support, but the direction of it largely depends on the elected leader and subsequent path for Brexit. On economic data front, UK’s GDP and manufacturing production data is to be released today at 4.30pm (GMT +8:00) and both are forecasted to have fallen relative to last month’s, extending the downwards pressure on GBP thus far. GBP/SGD pair is currently trading at 1.735 range.

Disclaimer: The above comments are only our views and should not be construed as advice. You should act using your own information and judgment. Although information has been obtained from and is based upon multiple sources the author believes to be reliable, we do not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute the author’s own judgment as of the date of the briefing and are subject to change without notice. Error & Omission Excepted.