1MIN READ

The Week’s Preview

GBP

The UK trading session on Friday ending with an improvement experienced in Retail Sales. The MoM figure showed the highest increase highlighting the relative improvement the UK retail industry has experienced. Overall the UK economy remains weak. This week, PMI figures will be released on tomorrow from 4pm (SGT) onwards.

AUD

The Australian dollar is starting the week under anti-risk sentiment pressure. Rising COVID-19 cases from around the world have been influencing the risk-sensitive Aussie dollar. Today, all eyes will be on RBA Governor Philip Lowe’s speech this morning to talk about the Global Economy and COVID-19. The RBA has shown previously they are ready to act when necessary and traders will be listening in to Governor Lowe’s comments to find any signals of this.

USD

The Dollar closed on Friday slightly higher as investors fear a second wave of infections that could halt a global reopening. Federal Reserve Chairman Jerome Powell maintained that the Fed’s stance on the economy was one of support and that the impact of the pandemic has exposed weaknesses in many industries that were already suffering. The week ahead will see PMIs figures tomorrow, followed by Q1 Final GDP print and Durable Goods Orders for May on Thursday.

EUR

Looking ahead this week, European data releases will begin on Tuesday with manufacturing PMIs for France, Germany and Europe for June which are all expected to improve. Following this, Wednesday will see the German business climate index which is forecast to rise to 85 from 79.5. The week then comes to an early close for Europe with the last release being German consumer climate and France job Seekers total out on Thursday.

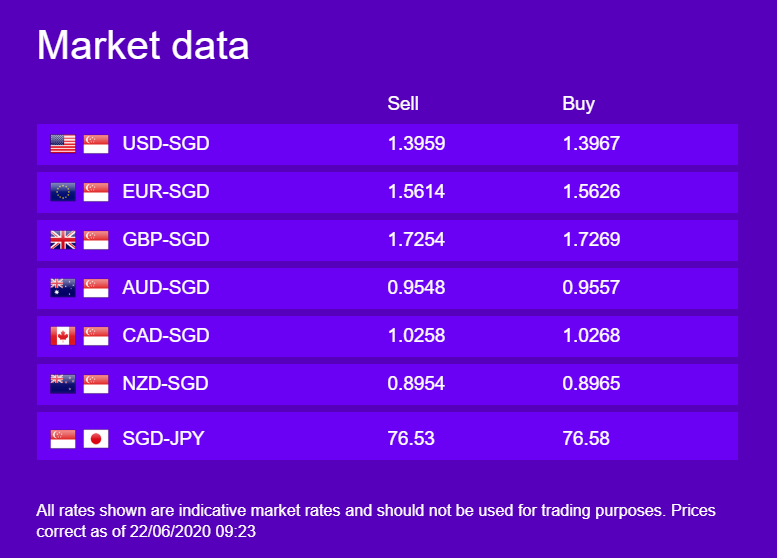

More live market data →

Login to trade →

Disclaimer: The above comments are only our views and should not be construed as advice. You should act using your own information and judgement. Although information has been obtained from and is based upon multiple sources the author believes to be reliable, we do not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute the author’s own judgement as of the date of the briefing and are subject to change without notice. Error & omission excepted.