Fed Ready to Jump in to Maintain Growth

Powell ready to act to sustain expansion

Post yesterday’s Hari Raya holiday, for the remainder of the week, we have US nonfarm payrolls report for May due tomorrow night at 8.30pm (GMT +8:00). It follows a surprisingly weak addition of 27,000 private sector payrolls. Economists have however pointed out that while the soft ADP number is an anomaly, they do think the job market is weakening and will weaken further if the President continues on his tariff warpath.

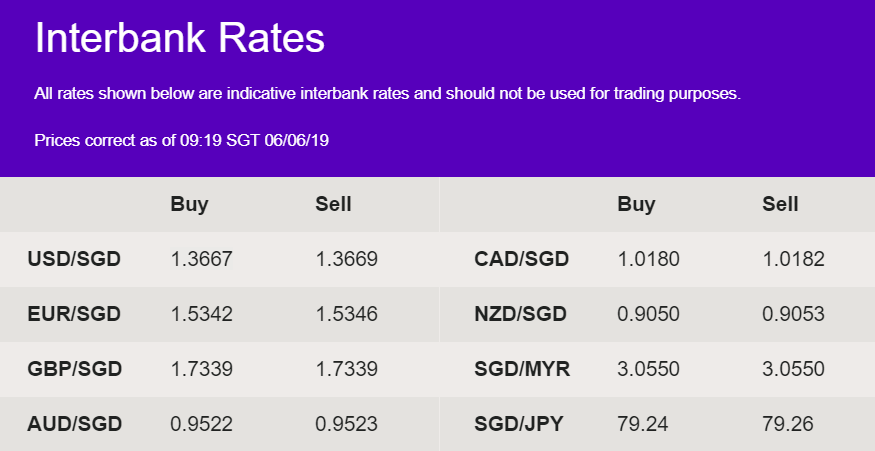

Fed Chairman Jerome Powell also said the central bank is watching current economic developments and will do what it must to keep the expansion going. Powell did begin his speech addressing the developments in trade negotiations, stating that “We do not know how or when these issues will be resolved. We are closely monitoring the implications of these developments for the US economic outlook and, as always, we will act as appropriate to sustain the expansion, with a strong labor market and inflation near our symmetric 2% objective.” USD/SGD pair is currently hovering at 1.366 interbank rate.

Weak consumer spending drags down GDP figure

The Australian economy grew by just 0.4% in the March quarter, contributing to a seasonally adjusted growth rate of 1.8%. The result contrasts with real GDP growth of 2.25% forecast in the budget, meaning the economy would have to grow by 1.3% in the last quarter of 2018-19 to meet the forecast.

The result was dragged down by weak household spending, contributing just 0.1% to growth. The rapidly cooling residential construction sector was also a significant drag, as dwelling investment fell 2.5% over the quarter. AUD/SGD fell by 0.27% yesterday.

Disclaimer: The above comments are only our views and should not be construed as advice. You should act using your own information and judgement. Although information has been obtained from and is based upon multiple sources the author believes to be reliable, we do not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute the author’s own judgement as of the date of the briefing and are subject to change without notice. Error & omission excepted.