Australia’s Unemployment Rate Holds Steady

AUD in downwards spiral

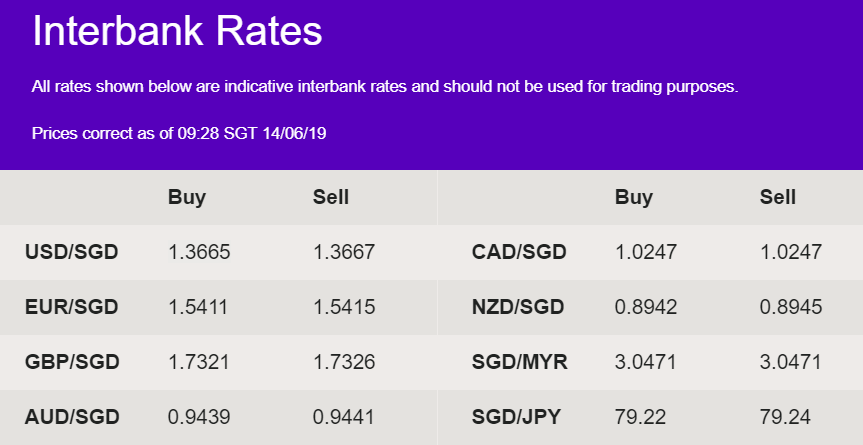

The latest quarterly job figures released yesterday, paints a pretty bleak picture for the slowing Australian economy, with the need for workers in the healthcare and construction sectors. Figures showed the unemployment rate remained stuck at 5.2%, despite the creation of 42,300 jobs in May. The increase in jobs failed to reduce the unemployment rate because a record 66% of adults were either in jobs or looking for work last month. This will only increase the pressure gauge on the RBA to cut rates further this year. AUD/SGD is currently trading at 0.94 interbank levels.

China auto sales slow

Further signs emerged that the Chinese economy is feeling the effects of the trade war with the US. Consumer inflation rose at an annualised rate of 2.7% in May. However, producer price inflation slowed to 0.6%. Most alarmingly, Chinese auto sales plunged 16.4% in May, its worst monthly & 11th successive decline on record. The soft numbers are reflective of the slowdown which has gripped the Chinese economy, and investors remain concerned as the trade war with the US shows very few signs of improving.

Disclaimer: The above comments are only our views and should not be construed as advice. You should act using your own information and judgement. Although information has been obtained from and is based upon multiple sources the author believes to be reliable, we do not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute the author’s own judgement as of the date of the briefing and are subject to change without notice. Error & omission excepted.