Aussie Under Pressure From Employment Data

AUD stuck in downwards trend

The forecast for the employment data to be released at 9.30am (GMT +8:00) may offer little support for the Aussie dollar as unemployment rate is expected to narrow to 5.1% and the employment change is expected to be 16k. This sets the RBA on track to implement further rate cuts in attempts to stimulate the economy. The Aussie has weakened steadily from record lows interest rate, and the downwards pressure on the currency seems unlikely to be relieved any time soon. AUD/SGD fell by 0.24% yesterday.

Dollar brushes off CPI data

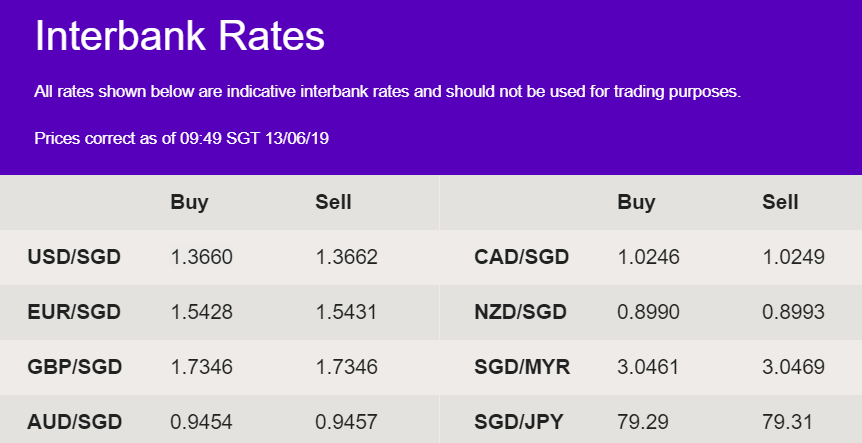

US core inflation rate came in lower than expectations at 0.1%, but the Dollar shrugs this off and appreciated against most major currencies yesterday. This was mainly due to the market cooling off of bets for a rate cut from Fed, which had fuelled the depreciation of the USD lately. The US core retail sales data will be released tomorrow night at 8.30pm (GMT +8:00) and it is forecasted to have increase from previous month at 0.5%. USD rose against SGD by 0.22% yesterday and is currently trading at 1.36 interbank levels.

Disclaimer: The above comments are only our views and should not be construed as advice. You should act using your own information and judgement. Although information has been obtained from and is based upon multiple sources the author believes to be reliable, we do not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute the author’s own judgement as of the date of the briefing and are subject to change without notice. Error & omission excepted.