There can be great benefits in working with an FX company who specialises in small business money transfers. If your business is paying overseas suppliers or collecting overseas revenues you could be benefiting from making the switch from your bank. Here are some tips for managing your small businesses money transfers.

Pay suppliers overseas with a bank-beating exchange rate

Switching from your bank to a provider like WorldFirst can lower the cost of your overseas supplier payments by achieving better exchange rates and paying less fees. Once you’ve signed up for an account there a few quick steps to paying an overseas supplier:

- Receive your invoice in a foreign currency. Some of our common currencies for supplier payments are USD, EUR, HKD, CNH, NZD and GBP.

- Add you beneficiary online or through account manager.

- Secure your exchange rate with WorldFirst online or through your account manager.

- Send your money to WorldFirst.

- We pay your supplier. This can be as fast as same-day for major currencies.

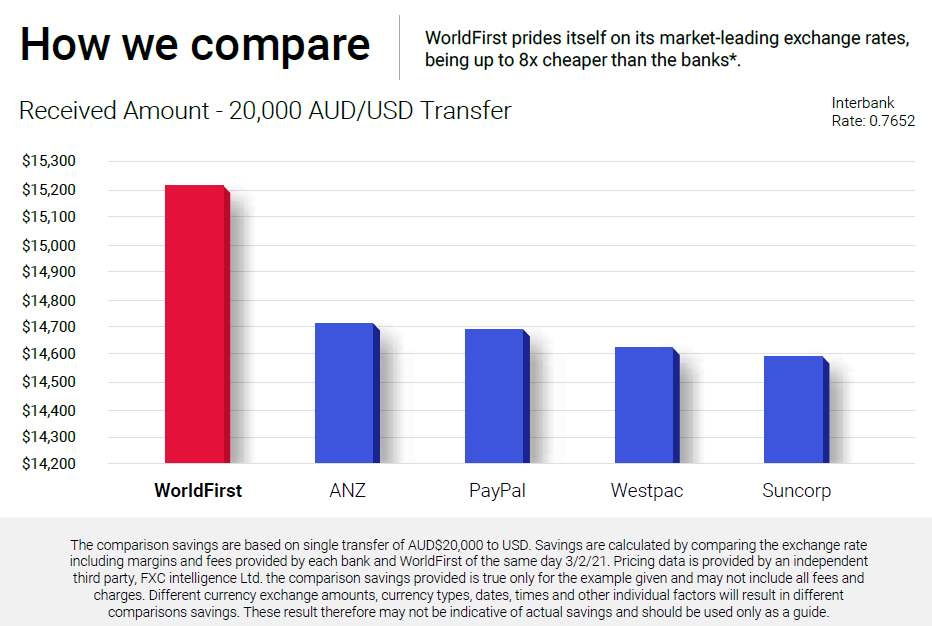

Make an international money transfer comparison

When choosing any supplier for your small business it’s always smart to compare. Read reviews on comparison sites or simply ask your bank for an exchange rate and compare with an FX specialist. You can do this on many FX specialists’ websites or you can call in. WorldFirst’s customer rate can be found on our homepage converter.

Source: Third party comparison tool FXC intelligence.

Forward contracts for your small business money transfers

A forward contract allows a business to lock in an exchange rate for up to two years. Currency markets can be very volatile, so this helps with budgeting and can be particularity useful when a business has an invoice due in the future and likes the current exchange rate. Forward Contracts do require a deposit so it’s best to speak to a currency specialist first.

The AUD/USD exchange rate has a big impact on importers based in Australia. Volatility can be extreme in uncertain economic times.

Multi-currency account for your small business

It’s not easy for small businesses to access local currency account details in foreign countries. World Account gives your business access to local currency account details in USD, GBP, EUR, NZD, AUD, CNH, JPY, SGD, CAD and HKD. This allows your small business to collect in local currency, make overseas same-currency payments and hold funds.

Sign up to WorldFirst

Sign up to WorldFirst today and start saving on your small business money transfers.

Whilst every effort is made to ensure the information is accurate, you should confirm the latest exchange rates with WorldFirst prior to making a decision.

The information published is general in nature only and does not consider your personal objectives, financial situation or particular needs and is not recommending any particular product to you.

Full disclaimer available online