Learn how leading retailers like Budgy Smuggler & Caden Carbon Wheels are reducing costs in all the right places.

2021 is now well and truly underway, so we take a look at some of the best ways retailers can cut costs and manage volatility in uncertain times.

Getter a better exchange rate on overseas supplier payments

One of the easiest ways for a retailer to reduce their costs is by ditching their bank to achieve better exchange rates when paying overseas suppliers. The cost of a transfer is often hidden in the margin, that is the difference between the exchange rate your currency is bought for and what rate you receive as the customer. So, don’t just look at a fixed fee when comparing the cost of your international payments.

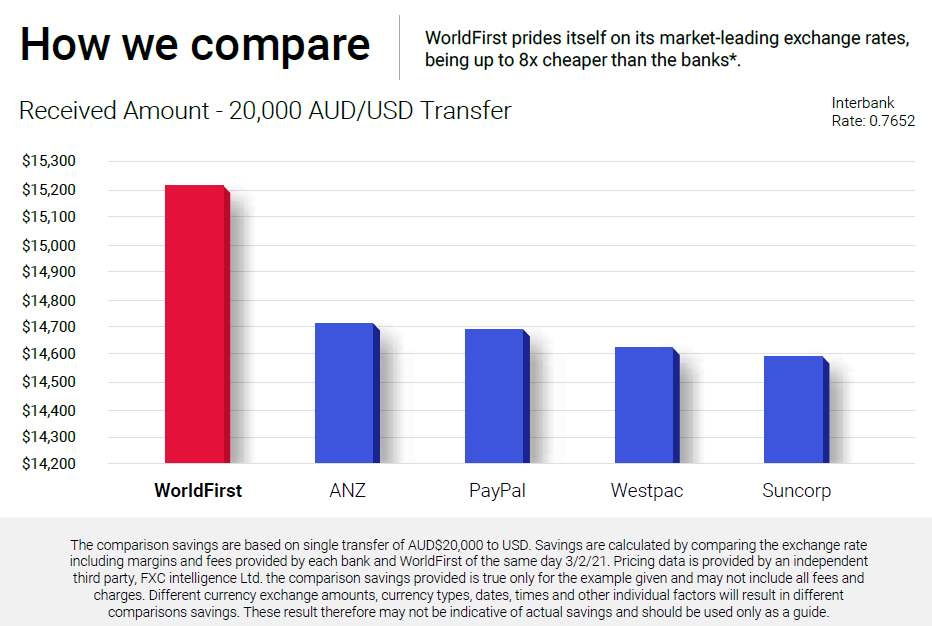

The table below uses a third party tool to compare the exchange rate you could achieve with WorldFirst and four other providers on a AUD to USD $20,000 transfer.

Learn how Budgy Smuggler saves on their overseas supplier payments

Access local currency accounts for overseas eCommerce sales

If your retail business is selling in overseas markets like North America, Europe, Asia or even New Zealand you could benefit by getting access to local currency accounts.

A multi-currency business account, like World Account, will allow you to collect overseas sales in local currency, hold those funds and make same-currency supplier payments direct from one platform. This can mean faster collection of funds, cheaper transfers and a better customer experience.

Learn how World Account helped Caden Carbon Wheels do global business like a local

Reduce uncertainty using Forward Contracts

Currency markets are volatile, nobody truly knows how a currency pair will move in the future. One way to increase certainty is by locking in a Forward Contract.

A Forward Contract locks in a rate for up to two years, so you’re protected if a currency moves against you. This tool is useful when you have a set amount of currency you need to buy for a defined period of time, like a supplier payment due in six months. The downside of a Forward Contract is if a currency strengthens in your favour you’re locked into a lower rate.

The AUD/USD pair is a great example of how volatility can impact your profit margins. In the past 12 months the pair has traded between 57c and 77c.

Start saving with WorldFirst today

Find out why over 250,000 clients around the globe have chosen WorldFirst for their international money transfers.

- Enjoy bank-beating exchange rates with money transfers up to 8x cheaper than the banks.

- Make transfers through your dedicated account manager or online 24/7.

- Collect, convert and make payments with our multi-currency account for online sellers.

Disclaimer:

These comments are the views and opinions of the author and should not be construed as advice. You should act using your own information and judgement.

Whilst information has been obtained from and is based upon multiple sources the author believes to be reliable, we do not guarantee its accuracy and it may be incomplete or condensed.

All opinions and estimates constitute the author’s own judgement as of the date of the briefing and are subject to change without notice.

Please consider FX derivatives are high risk, provide volatile returns and do not guarantee profits.