What is a Multi-Currency Account?

Multi-currency accounts, also known as, foreign currency accounts allow you to receive payments from your customers and make payments in the same currency. This will provide your business with local bank account details to allow you to bill in foreign currencies; taking your local business global. Beyond receiving these funds in local bank account details you are also able to hold and pay in local currencies.

Why Exporters May Need a World Account?

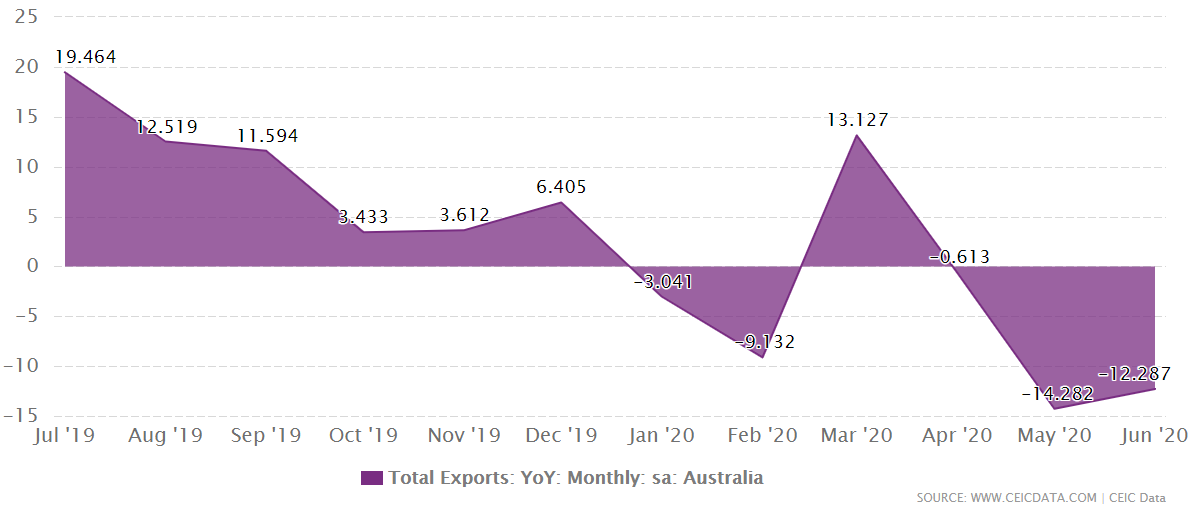

With COVID-19 affecting businesses globally, Australia’s Total Exports dropped 12.3% YoY in June 2020, according to the most recent CEIC data. This has resulted in Australian exporters in such unprecedented times needing to focus on having a tighter focus on their bottom lines. As stated by Matt Phelan, WorldFirst Australia Country manager in a recent acuity magazine article, “COVID-19 is obviously incredibly stressful for businesses and the people behind those businesses at the moment, and when revenue is down, cost management becomes the most important tool for survival.”

Saving money on foreign exchange when receiving cross-border payments for exported for your business, is a quick win for putting money back into your business bottom lines and budget your cash flows.

Benefits of Multi-Currency Accounts for Exporters

Easily Open Multi-Currency Accounts from Australia

Opening international business accounts from Australia can be difficult, however, with multi-currency accounts you are able to access local bank account details, allowing you to invoice in local currency. WorldFirst offers, World Account offering 10 currency accounts in USD, GBP, EUR, CAN, JPY, AUD, SGD, NZD, HKD & CNH. The benefits of these include:

- Free to open multiple currency accounts

- No monthly account fees

- No annual transfer limits

- Transparent margins of 0.60% or less

The World Account not only offers the ability to receive these funds but make foreign same currency payments directly from your account all on a single platform. This makes the payment process cheaper and faster.

WorldFirst pricing

WorldFirst offers transparent pricing of 0.60% or less based on your annual transfer volume and charge no fees on cross-currency transfers. This means market-leading exchange rates which helps improve your business’ bottom line. There’s also no need to negotiate a margin for every transfer, you’ll always know how much your international payments will cost and can take comfort knowing that you’ll be achieving one of the best exchange rates available.

The Fluidity of World Account

Disclaimer:

These comments are the views and opinions of the author and should not be construed as advice. You should act using your own information and judgement.

Whilst information has been obtained from and is based upon multiple sources the author believes to be reliable, we do not guarantee its accuracy and it may be incomplete or condensed.

All opinions and estimates constitute the author’s own judgement as of the date of the briefing and are subject to change without notice.

Please consider FX derivatives are high risk, provide volatile returns and do not guarantee profits.