SMEs using their bank to make international payments or to collect overseas funds could be losing out on thousands of dollars a year through hidden currency conversion costs. Importers, exporters and eCommerce businesses are benefiting from ditching their bank for international payments specialists.

Could your business be spending up to 8x more than it should be?

Do you know the real cost of your international payments?

The cost of a foreign exchange transaction is not only the set fee charged, but also the margin taken by your FX provider on the exchange rate.

The margin is the difference between the foreign exchange rate your provider buys your currency for, and what your end customer exchange rate is. Your goal should be to achieve an exchange rate as close as possible to what you see on Google. Businesses should be looking to avoid any set transaction fees on cross-currency payments.

Banks vs international payments specialists

It’s quite common for banks to take a margin of over 5% and charge a set fee. International money transfers are a low priority for many banks as they make the most of a lack of awareness of costs and other non-bank options available.

The high cost of using banks for international payments has led to FX specialists emerging to provide a cheaper and more effective option for businesses and individuals. WorldFirst have helped over 250K clients since 2004, making over 1M transfers per year.

WorldFirst pricing

WorldFirst offers transparent pricing of 0.60% or less based on your annual transfer volume and charge no fees on cross-currency transfers of AUD $10,000 or more. This means market-leading exchange rates which helps improve your business’ bottom line. There’s also no need to negotiate a margin for every transfer, you’ll always know how much your international payments will cost and can take comfort knowing that you’ll be achieving one of the best exchange rates available.

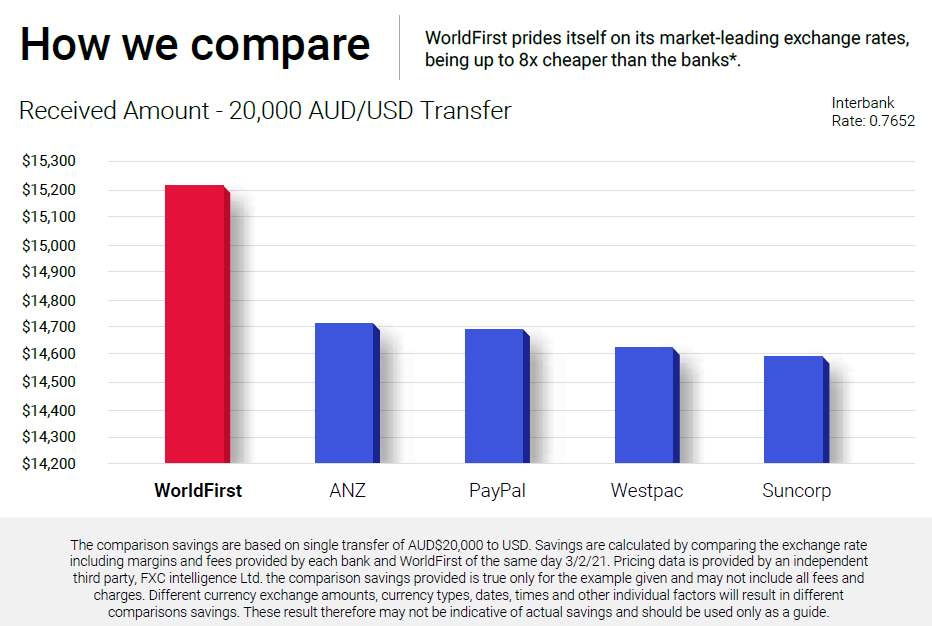

Make a comparison

It’s not always easy to work out the full cost of an international payment, so below is a sample from various providers using a third-party comparison tool.

What types of businesses can benefit from using an international payments specialist?

Importers

SMEs in Australia and New Zealand rely heavily on imports. The cost of manufacturing local goods often doesn’t stack up for businesses operating in industries like furniture, retail, agriculture, heavy machinery, food & beverage and fashion.

Paying suppliers overseas can be one of the most significant costs for a business, so achieving the best possible exchange rate can have a huge impact on your bottom line. Products like Forward Contracts can also help increase certainty for your business.

Exporters & eCommerce businesses

If you are an exporter or run an eCommerce business, chances are you are collecting funds in foreign currency. Accessing local bank account details in currencies like USD, GBP, EUR and NZD will help turn your global payments into local payments, as you can invoice in local currency and connect to global marketplaces and payment gateways.

World Account give your business free access to local bank details in 10 currencies. You’ll be able to collect in local currency, hold funds and make same-currency payments direct from your account.

What else should you look for in a international payments specialist?

Outside of great exchange rates and accessing local currency accounts, here are a few factors to consider:

- Do you receive a dedicated account manager?

- What products do they offer – spot contracts, forward contracts, multi-currency receiving accounts?

- How long has your FX specialist been operating for?

- Does your current international payments specialist have positive customer reviews online through providers like Trustpilot, Product Review or Google?

How to sign up for a WorldFirst account

It’s free to open an account with WorldFirst, there are no regular account fees and no annual limits of transfers. There are a few easy steps to make your first international payment with WorldFirst:

- Sign up for your account online in just a few minutes.

- We will ask for a couple of documents to get to know your business.

- You’ll be allocated your account manager as well as local bank account details for all the currencies you require.

- Enjoy your account! From there, if you’re accepting funds from overseas customers, you can collect into your new currency accounts. If you are making supplier payments, you can add your beneficiaries and make payments to them online or through your account manager.

Whilst every effort is made to ensure the information is accurate, you should confirm the latest exchange rates with WorldFirst prior to making a decision.

The information published is general in nature only and does not consider your personal objectives, financial situation or particular needs and is not recommending any particular product to you.

Full disclaimer available online