Currency market volatility has impacted many global businesses during the pandemic, but what can finance directors do to reduce risks from future fluctuations?

Australian businesses with overseas operations have been handed some harsh lessons during 2020 as the economic mire from the coronavirus pandemic manifested on company balance sheets.

Currency market volatility and supply chain interruptions caught out hundreds of companies during the early weeks of COVID-19, highlighting the importance of comprehensively managing foreign exchange risks through a structured strategy with a chosen partner.

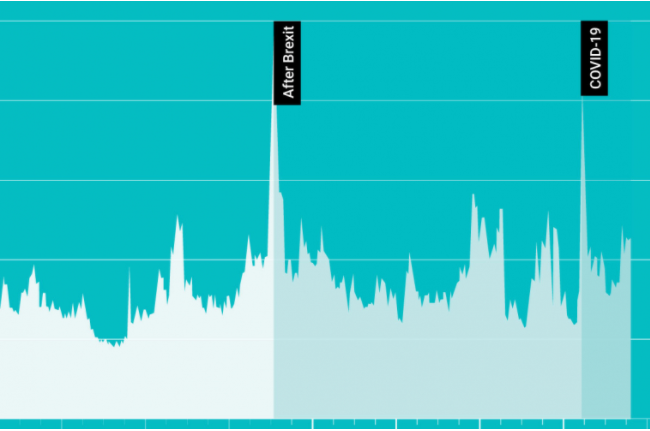

In the relatively calm markets of recent years, some finance directors may have overlooked developing a company-wide foreign exchange policy. While there was a spike in volatility in 2016 after the Brexit vote, 2018 and 2019 were relatively calm.

But in 2020, this would have proved costly. On March 20, AUD fell to its lowest level against the US dollar for 5 years, with the AUD/USD exchange rate moving from 0.68 to 0.58 in the space of a few days.

Those companies that were making US-dollar payments from AUD during that period, without any forward contracts in place, would have seen a dramatic difference in the amounts paid from the same payment had it been settled on March 10, compared to March 20.

Furthermore, if they were relying on their traditional provider of banking services, they may have been additionally hit by uncompetitive exchange rates, delays in settlement or higher charges for the service.

“Up to 70 per cent of small and medium-sized enterprises use their banking partner for cross-border foreign exchange payment services,” says Matthew phelan, managing director, Australia & New Zealand, at WorldFirst.

“Because they have a trusted relationship, they tend to use their banking provider for multiple services, but that can sometimes mean they get the raw end of the deal.”

If they haven’t already done so, company directors with significant overseas transactions should move quickly to help mitigate against further volatility, with predictions that markets are likely to continue their unpredictable behaviours well into 2021.

Forward planning

Those seeking greater visibility of their future costs may opt to use a forward contract. Forward contracts allow you to secure an exchange rate for a defined period in the future, helping with cash-flow planning and potentially mitigating currency risk.

By embracing this approach, company directors can more easily budget for future revenues, costs from overseas transactions and book transactions ahead of time yet funding them at a later date.

Companies may need to agree pricing with a supplier and, if they are buying or selling at spot, that is an unknown.

While forwards can be a useful tool for fiscal planning, finance directors should be aware that a lack of transparent pricing can sometimes be used to inflate providers’ profits.

By comparison, WorldFirst explicitly breaks down how it has priced its service upfront. Forward points are never used as a mechanism to charge more but are instead used to reflect interest rate differentials between two currencies.

Digitalisation and global trading

The World Trade Organization suggests the pandemic may result in increased levels of international trade longer term, which means the use of currency risk management solutions could become a popular and prudent choice for businesses.

“The global nature of COVID-19 and its impact on ecommerce may encourage strengthened international co-operation and the further development of policies for online purchases and supply,” it concluded in a May 2020 ecommerce report. Yet, while businesses have been quick to embrace online trading, many have not considered the consequences of generating revenues in multiple jurisdictions.

This under appreciation of currency risks can partly be attributed to the traditional opacity of the currency exchange market.

Most traditional providers are willing to quote you a rate for a transaction, but few are willing to offer a cost. They may make additional charges for services such as account opening or annual maintenance.

It can also be very difficult to compare exchange rates in real time as markets move so quickly. So, if businesses call multiple providers, they won’t be comparing rates at the same point in any one day.

Worse still, a company may receive introductory favourable terms as an incentive for them to use a provider’s service, only to see this rate deteriorate over time.

In an attempt to navigate this complexity, WorldFirst has designed a clear fee structure, based on the annual amount transferred in any one year. A transaction is charged 0.6% or less.

Multiple uses

COVID-19’s effect on international business has already been profound. For the global travel and tourism market, there has been enormous disruption. Airlines have faced mass cancellations and refunds, while hotel bookings between hoteliers and travel companies have also been withdrawn.

Finance directors operating in the travel sector have needed to handle refunds from foreign market suppliers while wanting to avoid converting this cash back into sterling and crystallising a loss.

For companies without a bank account in each local jurisdiction in which they operate, WorldFirst offers currency accounts that can be opened in a matter of seconds.

Disclaimer:

These comments are the views and opinions of the author and should not be construed as advice. You should act using your own information and judgement.

Whilst information has been obtained from and is based upon multiple sources the author believes to be reliable, we do not guarantee its accuracy and it may be incomplete or condensed.

All opinions and estimates constitute the author’s own judgement as of the date of the briefing and are subject to change without notice.

Please consider FX derivatives are high risk, provide volatile returns and do not guarantee profits.