The FX industry has long been renowned for complex and unclear pricing structures driving customers to confusion in understanding whether they are getting a good deal. In Australia, this has been highlighted by the ACCC’s focus on pricing in their inquiry into Foreign Currency Conversion Services.

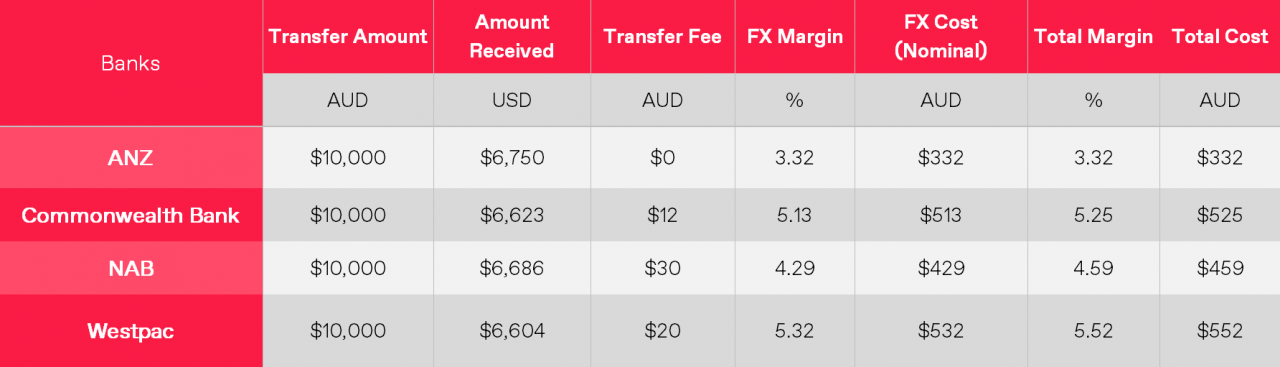

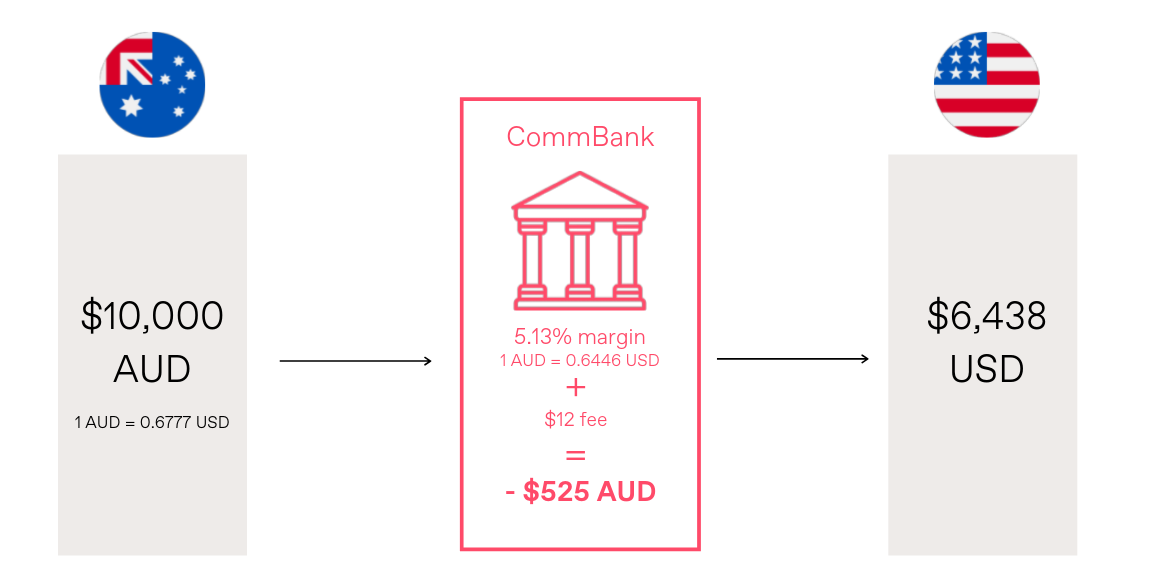

Most banks and providers will only communicate their set fee for a transfer, which can be as much as $30, however, the true cost of the transaction is hidden in the exchange rate. A margin, or spread, is the difference between what a bank or FX provider buys your currency for and what they sell it to you for. The interbank rate is the exchange rate you see on Google or the news; the aim should be to receive an exchange rate as close as possible to this number.

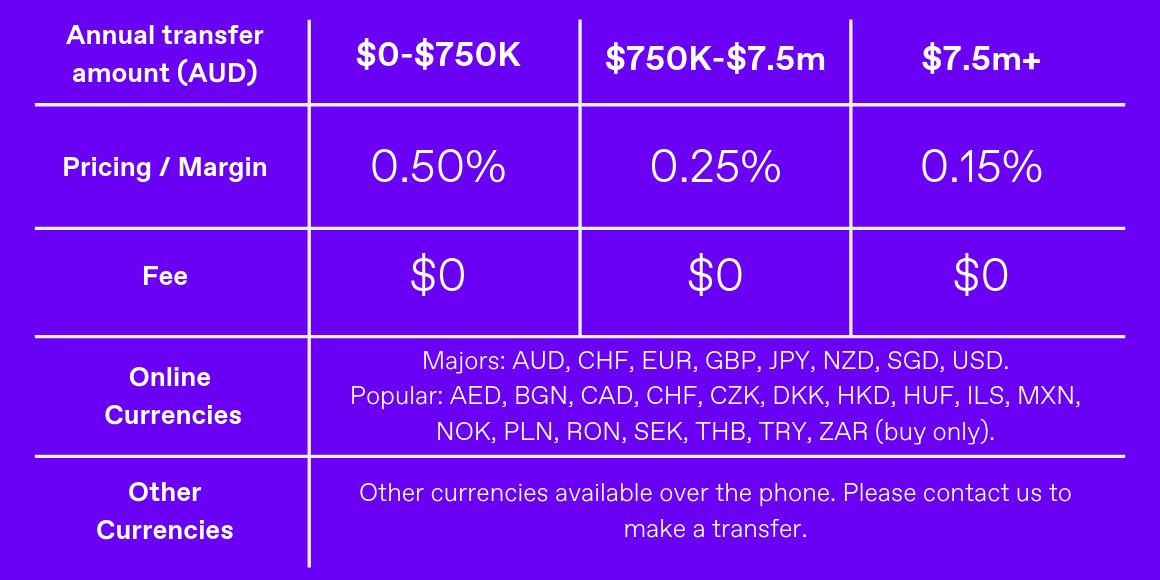

At WorldFirst we believe our clients deserve fair, simple and transparent pricing on all transfers. This is why we are excited to announce that we’ve launched standardised tiered pricing based on your annual transfer amount. These new prices are our cheapest ever transfers, making us up to 8 times cheaper than the banks.

The table below highlights our new pricing structure. Every single WorldFirst customer is eligible for this new pricing. This is a permanent change, so you will always know what price you are being charged upfront.

If you have questions regarding our pricing brackets please feel free to give us a call on 02 8298 4990 and our friendly client relations team will be more than happy to answer any questions you may have.