UK

Overnight the Pound experienced further pressure to move to the lowest levels since September 2019 against the AUD. It wasn’t all GBP weakness as the AUD benefited from improving sentiment and optimism that China had gained some control over the recent COVID outbreak. Reports suggest that the UK has experienced its fewest cases of COVID-19 since lockdown began in March which was positive for the Pound against the USD, up 1%.

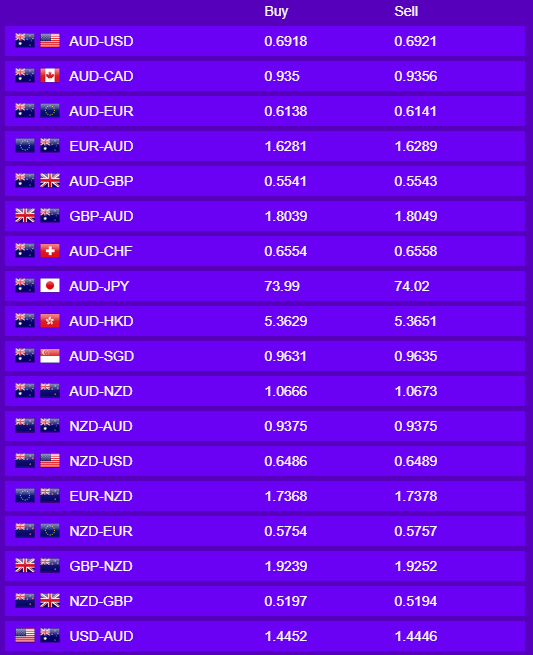

Looking ahead, UK PMI figures are due for release and with easing restrictions on businesses these are expected to improve. The nature of PMI’s as a leading indicator could have a sizeable impact on the Pound dependent on the result. Currently, the AUDGBP pair is trading at 0.5543 (1.8040).

Australia and New Zealand

The Australian dollar moved back up above the AUDUSD 0.69 barrier earlier this morning. The dollar appreciated off the back of comments from RBA Governor Philip Lowe as he assured Australia has “a fantastic set of underlying fundamentals”. This provided some positivity for the Australia economic recovery. The RBA reiterating they are refraining from cutting rates any further which offered some additional support for the AUD. Furthermore, US dollar weakness has also played a part in this recent increase as their COVID-19 cases continue to rise and US-China relations taking news headlines.

Looking at the day ahead we have the Commonwealth Bank of Australia releasing its June PMI figures, expecting to recover from 44 to 49.3. The forecast is still a contractionary figure but may show there is improvement within the economy which could help the Aussie dollar.

USA

The Dollar came under pressure during the US trading session, as investors turned “risk-on” as fears over a 2nd wave of infections fall and global economies continue to lift restrictions. The optimism saw risk exposed currencies appreciated overnight, with AUD rallying over 1%. The Chicago Fed Activities Index rose to record highs, posting 2.61 in May following the record low in April. Despite the significant recovery, it is likely still the US will fall into recession.

The US also experienced a worse than expected fall in Existing Home Sales, down to -9.7% on a forecast of -3.0%. This evening we will get Final PMIs for June.

Europe

Overnight with little data out Europe we saw the AUDEUR pair rise off the back of an uptick in risk sentiment following the Reserve Bank Of Australia Gov Lowe’s speech.

Tonight, we have the manufacturing PMI’s out for France, Germany and the EU for June which are accompanied by the Services and the Market Composite PMI’s for Europe. Overall the expectation is that the PMI’s will improve compared to May but will still remain in negative territory. It will be interesting to see whether the EUR finds some support should the forecasts be met. Currently, the AUDEUR pair is trading at 0.6139 (1.6289)

All rates shown are indicative market rates and should not be used for trading purposes. Prices correct as of 23/06/2020 09:13.

Jack Cincotta