Since our last newsletter, the AUD has been smashed to the downside. The risks to global growth associated with the coronavirus has pushed the AUD to 11-year lows against the USD. Financial markets are a zero-sum game, so depending on which side of the fence you’re sitting, spot payments have become up to 5% more expensive for our importers, while exporters are enjoying an uptick in profits.

Last month we indicated a break below the previous level of support of 0.6920 would likely suggest lower levels to come. The coronatrade well and truly pushed us through these levels, with the next level of support now having last traded at 0.6330. Unhedged importers are now really starting to feel the impact. Not only has the cost of their goods increased, but also their supply chains impacted. Following the previous newsletter, WorldFirst did see an uptick in stop losses around the 0.6900 level, executing as the market sold off. These trades were mostly rolled out into 3-month forward contracts, securing for them a significant competitive advantage over their unhedged rivals.

As previously discussed, it is important to note that the AUD is a commodity currency, meaning its fortunes rise and fall with global economic outlook. As importers and exporters with ongoing exposure, you need to be acutely aware of this fact. To demonstrate this point, the below chart highlights the inverse correlation that the AUD has with market volatility. As expectations of market risk increases, the AUD tends to weaken.

Source: tradingview.com

For the exporters, we suggested last month that those with some risk appetite may benefit by following the risk-off trend and transacting on spot. Those that remained unhedged were the biggest beneficiaries of this move.

Looking to the month ahead, the direction of the AUD will be dictated by any positive or negative news surrounding the coronavirus. If the infection rate continues to climb and it spreads into new territories, expect the economic impact to be priced into a weaker AUD. Any positive news and we’ll likely see a relief rally in the AUD. You may wish to consider positioning yourself accordingly with a mixture of spot and forward contracts combined with stop losses and firm orders. Please contact your account manager to assist with placing orders or developing a hedging strategy.

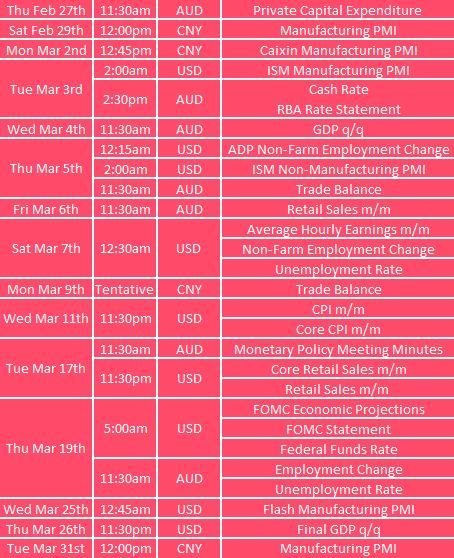

Key Releases for February/March

Below we include an economic calendar for the remainder of February and March. We highlight the key events to markdown. Ask your account manager how these releases will have a short-term impact on the rate so you can take advantage of any spikes if the data is better/worse than expected.

Business Currency Specialist

Disclaimer:

These comments are the views and opinions of the author and should not be construed as advice. You should act using your own information and judgement.

Whilst information has been obtained from and is based upon multiple sources the author believes to be reliable, we do not guarantee its accuracy and it may be incomplete or condensed.

All opinions and estimates constitute the author’s own judgement as of the date of the briefing and are subject to change without notice.

Please consider FX derivatives are high risk, provide volatile returns and do not guarantee profits.