Welcome to this month’s importer and exporter update, where we review key currency movements impacting Australian SME’s and look at how they’re managing their foreign exchange risk. Tim Macdonald, WorldFirst Currency Specialist

It’s been a wild ride for the AUD to close out the decade. The month of December saw early joy for importers, with optimism surrounding the trade war and USD weakness driving a significant rally.

Last month we indicated that a move above the short-term high of 0.6926, would likely result in breakout to the upside for the AUD. This is exactly what happened with the US and China agreeing to a truce in tariff escalation. With further risk in this regard being priced out, the AUD shot up, with further support being provided by some broad-based USD weakness. A new short-term high of 0.7032 was reached at the end of the month, a level not seen since July.

With this, WorldFirst saw a significant uptick in flows for forward exchange contracts. Importers were looking to lock in the rate and take advantage of this rally, with the more savvy executing firm orders at 0.7000. Exporters on the other hand were looking to minimize further AUD strength and lock in the rate for incoming funds.

At the time of writing this, market feeling has shifted with Middle Eastern geopolitics returning to the forefront of market concerns. The AUD’s fortunes (being a commodity currency), will rise and fall with global risk sentiment, and rising tensions between the US and Iran have hit it hard. Looking to the month ahead, the direction of the AUD will be determined by any escalation/de-escalation in this regard. With troops heading over to the Middle East and aggressive rhetoric from Iran, it’s unlikely we’ll see any significant progress though. The risk is to the downside here.

With 0.6920 (green line) offering support, a break below this could indicate lower levels to come. Therefore, a stop-loss just below this level may be a prudent decision to protect against further downside. Alternatively, businesses concerned about further weakness, locking up a proportion of your expected requirements into a forward may be a smart move now.

For the exporters, those with some risk appetite may consider the current trend their friend and continue transacting on spot. The next level to be wary of is the all-important psychological 0.7000 (red line). Any de-escalation between the US and Iran, or improvement in US-Sino relations would likely push the AUD through this level, testing the new short-term high of 0.7032. A stop loss around this price would limit the impact of such a move.

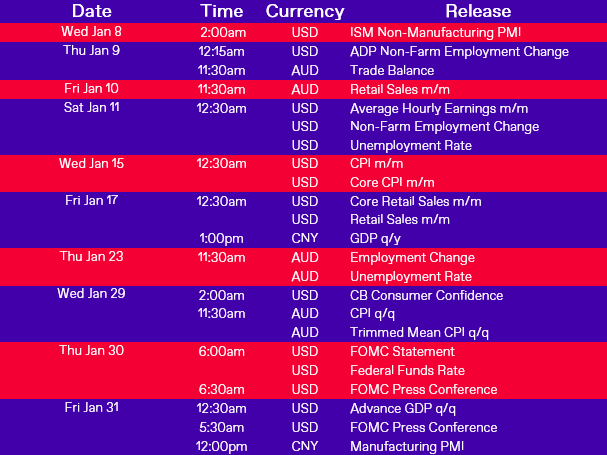

Key events releases for January

Below we include an economic calendar for the month of January. We highlight the key events to markdown. Ask your dealer how these releases will have a short-term impact on the rate so you can take advantage of any spikes if the data is better/worse than expected.

Disclaimer:

These comments are the views and opinions of the author and should not be construed as advice. You should act using your own information and judgement.

Whilst information has been obtained from and is based upon multiple sources the author believes to be reliable, we do not guarantee its accuracy and it may be incomplete or condensed.

All opinions and estimates constitute the author’s own judgement as of the date of the briefing and are subject to change without notice.

Please consider FX derivatives are high risk, provide volatile returns and do not guarantee profits.